In 2024 alone, Indian businesses lost over ₹1,200 crore to fraud involving fake or unidentified bank accounts. Whether it's a failed vendor payment, a salary transfer that vanishes, or a refund that never reaches the customer, even a minor error, or a fraudulent account can result in significant financial loss and reputational damage.

To prevent such risks, businesses must routinely verify a customer’s bank account before onboarding. It’s a crucial part of the KYC process, and in several regulated sectors, it’s a mandatory step enforced by compliance authorities.

So, what exactly is bank account verification, and why does it matter? In this article, we’ll explore how it works, why it is necessary, and why choosing the right platform can help keep both your business and your customers safe.

What is Bank Account Verification?

Bank account verification is the process of confirming that a bank account truly belongs to the individual or entity claiming ownership. This step is designed to protect businesses from fraud by ensuring they are dealing with legitimate account holders, not fraudsters or shell accounts.

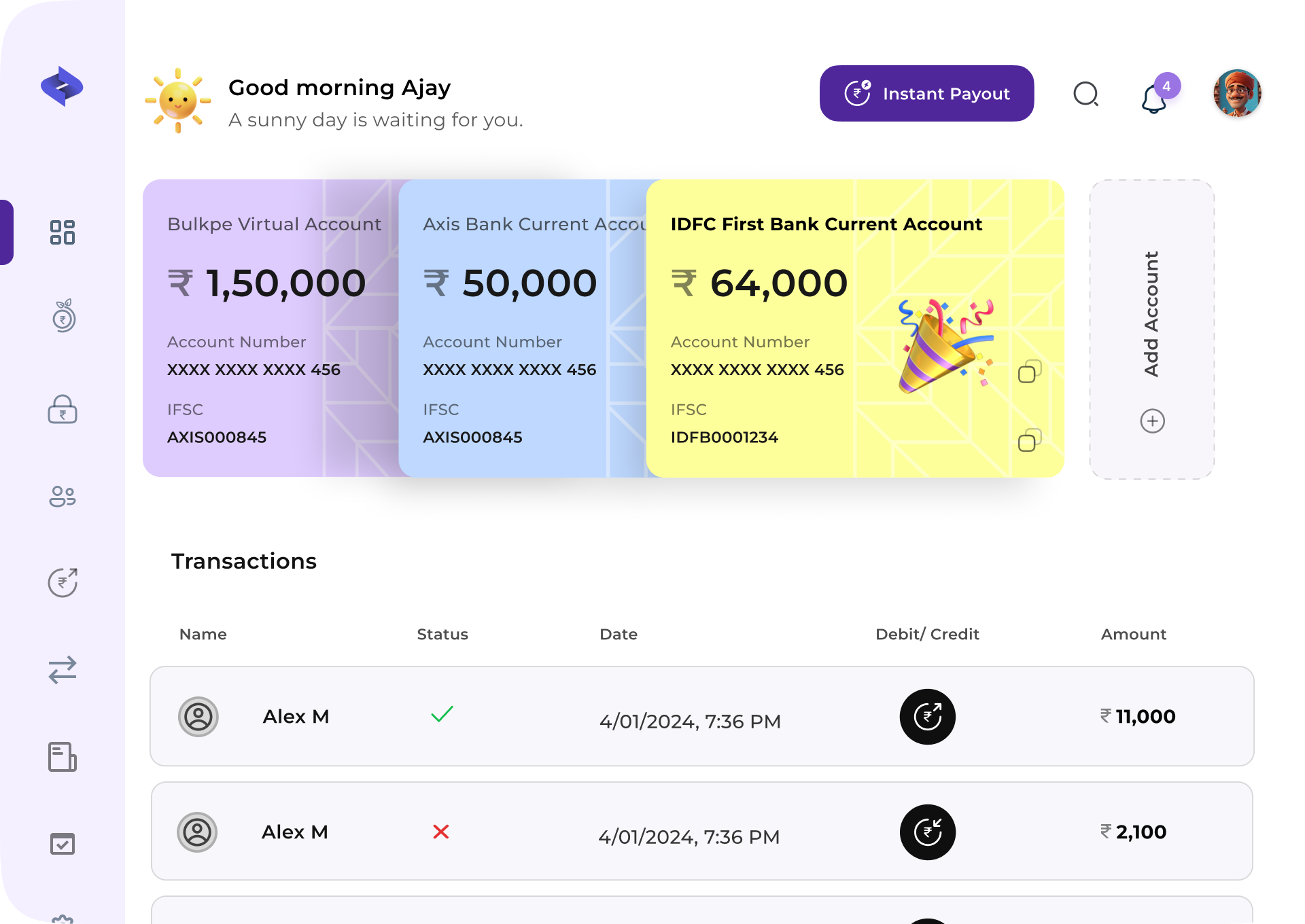

With bank account verification, checking a customer’s bank details is quick and effortless. Simply enter the bank account number and IFSC code, and the system instantly fetches the account holder’s name. It’s a fast and reliable way to confirm ownership and ensure secure transactions.

Why Bank Account Verification Matters

1. Fraud Prevention

With rising instances of financial fraud, verifying bank accounts before making any payout helps ensure money is sent only to verified individuals or businesses. This simple step drastically reduces the risk of fraud.2. Transaction Accuracy

Errors in bank account details, like a wrong digit or mismatched name can cause failed transactions or funds being credited to the wrong account. This leads to delays, operational friction, and customer dissatisfaction. Verification helps catch such errors before they happen.3. Customer Confidence

When customers know their money is being handled securely, it builds long-term trust. A robust verification process reassures them that their payouts, refunds, or disbursements are being sent to the correct accounts.The Bulkpe Verification Dashboard

The Bulkpe Verification Dashboard is built for speed, accuracy and ease of use whether you're a fast-growing startup or a large enterprise. It enables you to:- Instantly verify if an account number matches the holder’s name

- Do individual or bulk verifications as per your need

- Quickly know the verification status and the account holder’s name.

- Seamlessly integrate into internal systems using an API-first approach

How to Verify Bank Accounts with Bulkpe Dashboard

Verifying bank accounts is quick and hassle-free with the Bulkpe Dashboard. Here's how you can do it:1️⃣ Login and access the Bulkpe Dashboard using your credentials.

2️⃣ Navigate to the Verification tab and choose your method.

- Use the Pennyless to check if the account number matches the name.

- Use the Pennydrop to send ₹1 and verify account ownership.

3️⃣ Verify a single account manually or upload bulk data via CSV.

4️⃣ Click “Verify” and get the Account holder’s name and the status of verification.

How to Verify Bank Accounts with Bulkpe API

Verifying bank accounts is easy and secure with Bulkpe. Here's how it works:1️⃣ Sign up on Bulkpe and get your API key from the dashboard.

2️⃣ Choose your method:

- Use the Pennyless API to check if the account number matches the name.

- Use the Pennydrop API to send ₹1 and verify account ownership.

3️⃣ Send the account number and IFSC code to the selected endpoint.

4️⃣ Get instant results with the account holder’s name and verification status.

Bank account verification is no longer a nice-to-have tool, it’s prerequisite for businesses before making payouts. Making payouts after proper bank account verification not only reduces errors but builds stronger customer confidence. When customers, vendors, or partners know their money will land in the right account every single time it builds trust, credibility, and long-term relationships. Bulkpe makes this seamless with real-time verification and automated workflows that reduce manual errors and fraud risk. With Bulkpe’s verification stack, you can always make payouts with confidence that your money reaches the right person, at the right time, every time.

Sign up Now!We truly value your trust in Bulkpe as your reliable banking partner and always look forward to hearing from you. Whether you have a question, feedback, or just want to connect, we’re here for you. Click the link below to reach out and let’s stay connected!

Contact us?