Payout APIs power this shift. They allow businesses to automate disbursals directly from their systems using UPI, IMPS, NEFT, and RTGS. This means no logging into banking portals or managing endless spreadsheets. In 2025, several providers dominate this space. Here is a closer look at some of the most trusted payout APIs in India.

RazorpayX Payouts

RazorpayX offers a widely used solution for automated payouts and is part of the larger Razorpay ecosystem. It works best for companies already using Razorpay for collections. Features include:Pros

- Fully integrated with Razorpay payment gateway.

- Offers digital current accounts, payroll, and corporate cards.

- Clean dashboard and reliable APIs.

Cons

- Best value if you already use Razorpay.

- Broader focus means less specialization in complex payouts.

- Advanced features like payroll will be expensive.

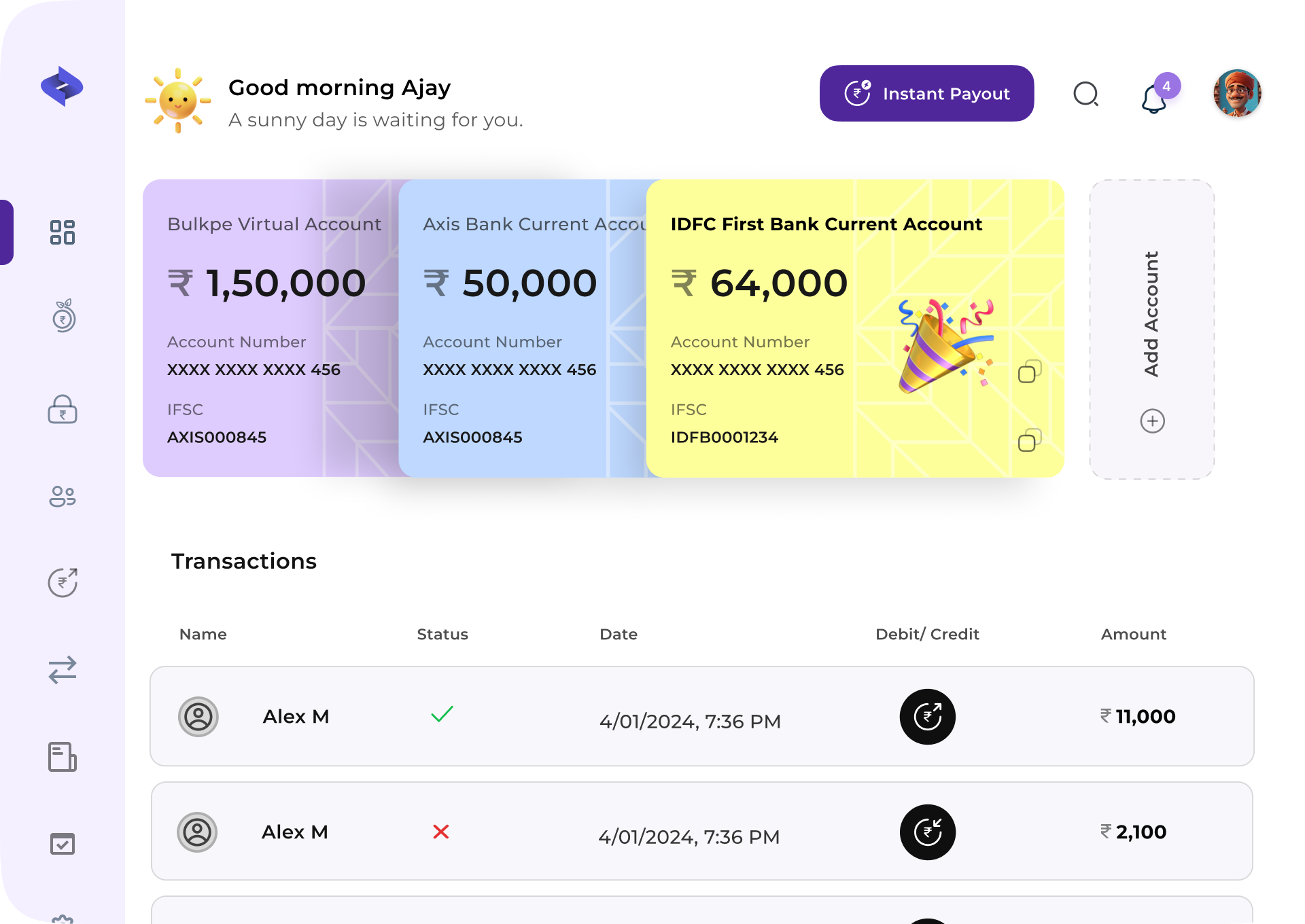

Bulkpe Payout APIs

Bulkpe takes a more specialized approach. Instead of covering everything, it focuses deeply on automation for recurring and high-volume payouts. Companies handling thousands of daily disbursements use Bulkpe APIs because it offers:Pros

- No daily/monthly payout limits (high volume focused).

- Live payment status with callback for high success rates.

- Integrates payouts with collections and identity verification.

- MSME-focused with digital current accounts (via partners).

Cons

- Newer player, less widespread recognition.

- Primarily for businesses with complex, high-volume needs.

- Relies on banking partners for current accounts.

Cashfree Payouts

Cashfree has been a strong player in the payouts space for years. Known for reliability and speed, its APIs enable:Pros

- Very fast and reliable payouts.

- Strong for marketplace settlements and split payments.

- Easy to integrate with good API documentation.

Cons

- Primarily focused on payouts; fewer other financial tools.

- Less comprehensive than platforms offering full financial workflows.

Paytm Payouts

Paytm provides enterprise-grade payout solutions that connect seamlessly with it's wider ecosystem. Features include:Pros

- Instant transfers to Paytm Wallets (huge user base).

- Good for bulk beneficiary management.

- Leverages the wide popularity of Paytm.

- MSME-focused with digital current accounts (via partners).

Cons

- Best if your beneficiaries are already Paytm users.

- Less flexibility for complex, advanced automation.

- The consumer focus is broader

Decentro Payouts

Decentro offers modular APIs that allow fintechs to integrate banking functions directly into their products. It's features include:Pros

- Highly developer-friendly APIs for custom builds.

- Modular system to embed various financial services.

- Sandbox environment for easy testing.

Cons

- Requires technical expertise; not plug-and-play.

- Primarily for building custom solutions, not a ready-to-use product.

- No pre-built dashboard for non-technical users.

The choice depends on your priorities. If you are looking for a broad neobanking experience with payouts as part of a full-stack platform, RazorpayX is a safe choice. If instant disbursals and speed are your top requirements, Cashfree and Paytm are both reliable. If your operations depend on high-volume payouts, recurring bill payments, advanced tracking, and deep reconciliation, Bulkpe is a strong choice as it brings these capabilities together in one stack. If you are building a fintech product that requires embedded finance features, Decentro is a strong fit.

In 2025, payouts are no longer a simple feature. They are an operational backbone for fast-growing companies. Picking the right partner depends on whether you need breadth or depth, but the tools available now make it easier than ever to pay with speed, accuracy, and control.

Sign up Now!

Whether you're seeking solutions, have a brilliant idea, or just want to chat about how Bulkpe can further simplify your financial life, our team is genuinely here for you. We’re just an email or click away. Reach out, and let's make your banking experience better.

Contact us?