Let's be honest, business payments is not just paying suppliers, you're also dealing with rent, bills, staff expenses, commissions, contractor fees, money coming in from the customer and all those other regular payments. It will land you in huge trouble if you don’t have a good payment aggregator in place.

Now we have so many players in the market, for handling the business payments, but back in time everything was done manual. Some still does it manually.

For many, RazorpayX has been the popular choice. But popular doesn't always mean it's the right fit for a business that's growing fast. If you're a startup, a fintech, a D2C brand, or a finance team, you're likely asking: Is RazorpayX still the best choice for us?

What if your main problem isn't just simple bank tasks, but managing all of it in various places ? While RazorpayX does well, its payroll features are known to be expensive, and the product itself is better suited when payouts alone are your focus. You can try other options in the market, doing things differently. This isn't about criticizing; it's an honest take from our side.

The Origin Story: What Are They Built For?

RazorpayX is a strong neobanking platform offering a broad suite of financial services like current accounts, payroll, tax tools, vendor payouts, and corporate cards. It works best for companies that want a general-purpose banking layer and are looking only to handle payouts as part of a larger ecosystem.

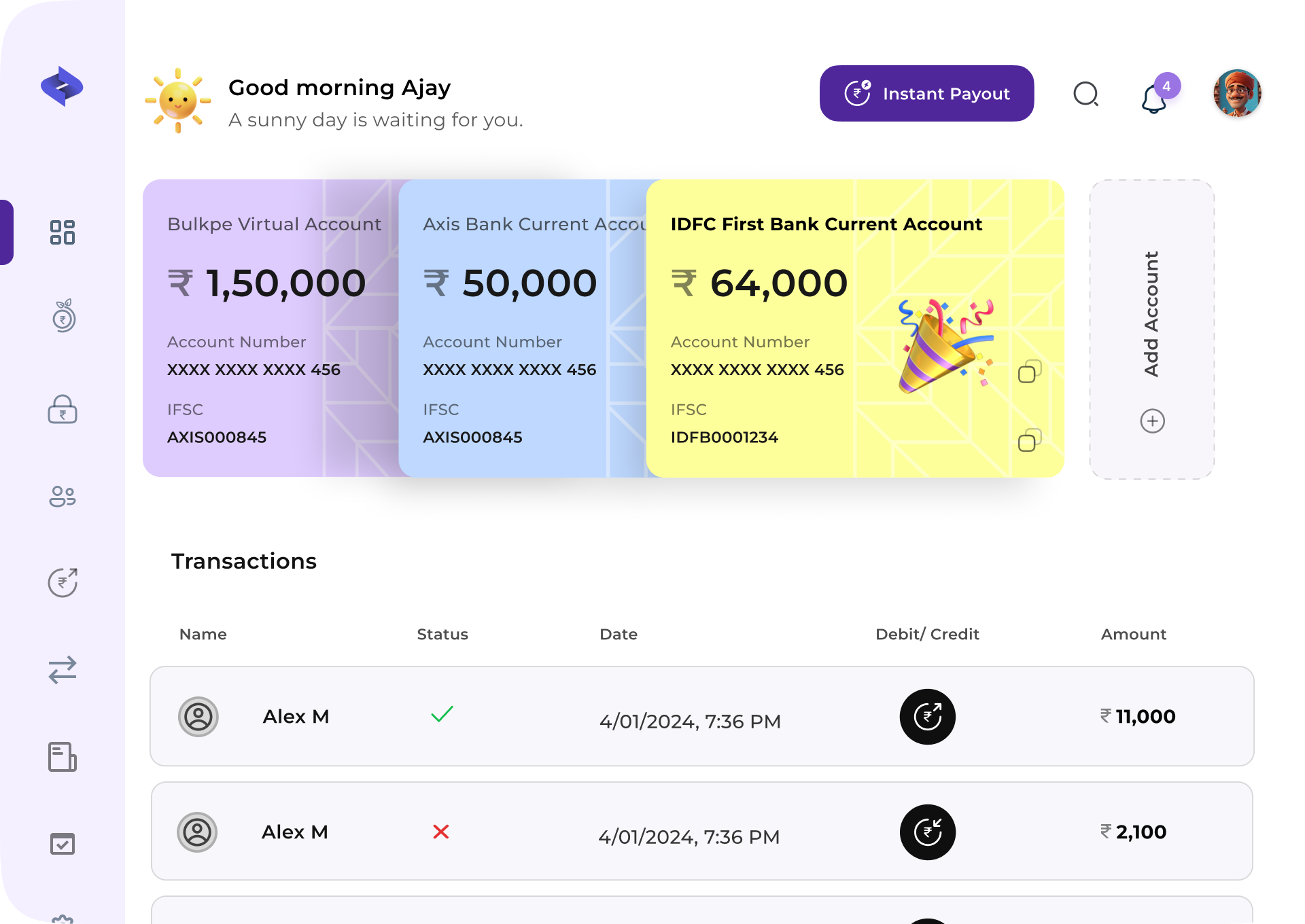

Bulkpe, on the other hand, is built for companies that need more than just payouts. It focuses on solving specific operational finance challenges by combining collections, payouts and real-time verification into one integrated stack. Instead of just sending money out, Bulkpe gives businesses a suite that automates high-volume financial workflows, tracks everything in real time, and eliminates manual intervention.

Both RazorpayX and Bulkpe aim to simplify financial operations for businesses, particularly startups and growing companies. However, they approach this goal with different philosophies and strengths, catering the customers with their needs.

Payouts and Collections: Volume and Control

RazorpayX provides standard vendor payouts, disbursal APIs, and basic collection tools with a clean user experience for simpler use cases.

Bulkpe provides payouts via UPI, IMPS, NEFT, and RTGS with real-time status tracking, fallback gateway options, no daily limits, and bulk disbursal tools. On the collections side, Bulkpe offers invoice-based payment links, auto-tagging of UTRs, and smart dashboards for tracking. This is especially useful for businesses that handle large volumes of vendor payments or incoming customer transactions.

Reconciliation: Complete Visibility

RazorpayX offers some tagging and statement-level visibility. However, invoice-to-payment mapping often remains manual.

Bulkpe provides invoice-to-UTR auto-reconciliation with exportable reports and live tracking. This reduces spreadsheet work and manual follow-ups, giving finance teams full control over high-volume transactions.

Verification Stack: A Key Differentiator

RazorpayX does not offer a dedicated verification suite.

Bulkpe includes a full verification stack with APIs for PAN, Aadhaar, Bank Account, GSTIN, IFSC, UPI VPA, and Credit Reports. This is essential for onboarding, vendor due diligence, and fraud prevention. It adds a layer of automation and security that is often missing in broader platforms.

Customer Support and Responsiveness

RazorpayX primarily relies on a ticket-based support system, where issues are logged through their dashboard or email and resolved based on predefined SLAs (Service level agreements). The response time and priority often depend on the customer’s plan, company size, or enterprise relationship, which can sometimes mean slower resolutions for smaller or mid-sized businesses.

Bulkpe provides real-time support through email, chat and WhatsApp, along with quick onboarding and custom escalation workflows. This is especially valuable for fast-growing businesses that need quick resolution of payment issues.

Who Should Choose What

Use RazorpayX if your primary need is a general-purpose neobanking setup for payouts and collections, especially when you already use Razorpay’s gateway and prefer to manage everything in one account. It’s a broad platform, but payroll and some advanced features can be expensive.

Choose Bulkpe if you need a single platform to automate payouts, manage collections, make your bill payments, get access to Bulkpe's prepaid cards and verify users or vendors with real-time APIs – all built for speed, control, and deep visibility.

While RazorpayX offers payouts and collections as part of its neobanking setup, Bulkpe brings a broader operational suite in one platform. Along with payouts and collections, Bulkpe also includes a verification stack and payment gateways. Choosing between the two comes down to whether you need a general-purpose banking layer or an integrated system built to manage and streamline the entire payment workflow.

Thank you for trusting Bulkpe as your payment partner. Your feedback and ideas drive our growth, and we’re always just a click away, whether you need support, have a question, or just want to share a thought.

Contact us?