In India’s growing credit ecosystem, access to accurate and timely credit data is more important than ever. As of 2024, over 450 million credit-active consumers are being tracked by credit bureaus, with more than 100 million new credit accounts opened annually. Among the four RBI-approved credit bureaus, CRIF High Mark plays a crucial role in assessing creditworthiness for individuals and businesses alike. In this blog, we cover what a CRIF credit report is, what impacts your score, its benefits, and how Bulkpe’s API makes accessing it seamless.

What is CRIF Credit Report?

The CRIF Credit Report is a comprehensive document generated by CRIF High Mark, one of India’s leading credit bureaus authorized by the Reserve Bank of India (RBI). It contains detailed information about an individual’s or business’s credit history, including their credit score, current and past loan accounts, repayment behavior, and recent credit inquiries. This report helps lenders evaluate the creditworthiness of borrowers before approving loans or credit cards. A good CRIF credit score ranges from 600 to 900, which can lead to faster approvals, better interest rates, and higher credit limits, making it a crucial tool in today’s financial decision-making process.

Importance of the CRIF Credit Report

The CRIF Credit Report plays a vital role in evaluating the financial credibility of an individual or business. It provides lenders with deep insights into past credit behaviour, repayment patterns, and overall creditworthiness. This report is not just a scoring sheet - it is a risk assessment framework that helps banks, NBFCs, fintechs and credit issuing platforms make confident lending decisions.

A strong CRIF credit score can lead to far better financial opportunities such as lower interest rates, faster loan approvals, higher credit limits, access to premium credit products, and better negotiation power while borrowing. For businesses, it also enhances trust among investors, lenders, suppliers, and financial partners. In short, CRIF credit report defines how the financial ecosystem views your ability to handle credit responsibly - making it extremely important in today’s lending and risk evaluation landscape.

Key Factors Influencing Your CRIF Credit Score

Several elements contribute to the calculation of the CRIF Credit Score:Payment History (35%) : Timely repayment of dues positively impacts the score.

Credit Utilization (30%) : Lower utilization ratios are favorable.

Credit History (15%) : Longer credit histories can enhance the score.

Credit Inquiries (10%) : Frequent loan or credit card applications can lower your score due to hard inquiries.

Benefits of a Good CRIF Credit Score

Maintaining a high CRIF Credit Score offers numerous advantages:

1️⃣ Faster Loan Approvals:

Lenders trust borrowers with higher credit scores, making approval processes quicker and smoother.

2️⃣ Lower Interest Rates:

High scores usually qualify for better and more competitive interest rates.

3️⃣ Higher Credit Limits: You are more likely to get higher credit card limits and larger loan amounts.

4️⃣ Better Negotiation Power: You can negotiate and demand better terms due to your financial credibility.

5️⃣ Enhanced Financial Reputation: A good score reflects disciplined credit behavior and builds long-term trust with financial institutions.

Credit Report Mistakes: How They Affect Your Score

Mistakes in credit reports are more common than you'd expect and they can seriously impact your financial health. From incorrect personal details, unrecorded payments to duplicate accounts and fraudulent transactions, even small errors can bring your credit score down. Regularly reviewing your report helps catch issues like identity mismatches, incorrect loan statuses, wrong balances, or accounts that don’t even belong to you. If you spot something wrong, raise a dispute with both the lender and the credit bureau. Just remember: bureaus can't make changes without confirmation from the lender, so fixing errors can take time and follow-up.

Understanding CRIF Credit Report Ratings

Here’s a simple table format to understand CRIF credit report ratings:

| Rating | Score Range | Meaning |

|---|---|---|

| Excellent | 750 & above | Demonstrates excellent credit behaviour and qualifies easily for premium financial products and lower interest rates |

| Good | 700-749 | Strong credit track record, viewed as a dependable borrower |

| Average | 650-699 | Credit access is available, though interest rates might be slightly higher |

| Fair | 600-649 | Loans may be approved with difficulty and at higher rates |

| Poor | Below 600 | Access to credit is limited, and improving your financial habits is essential to increase eligibility. |

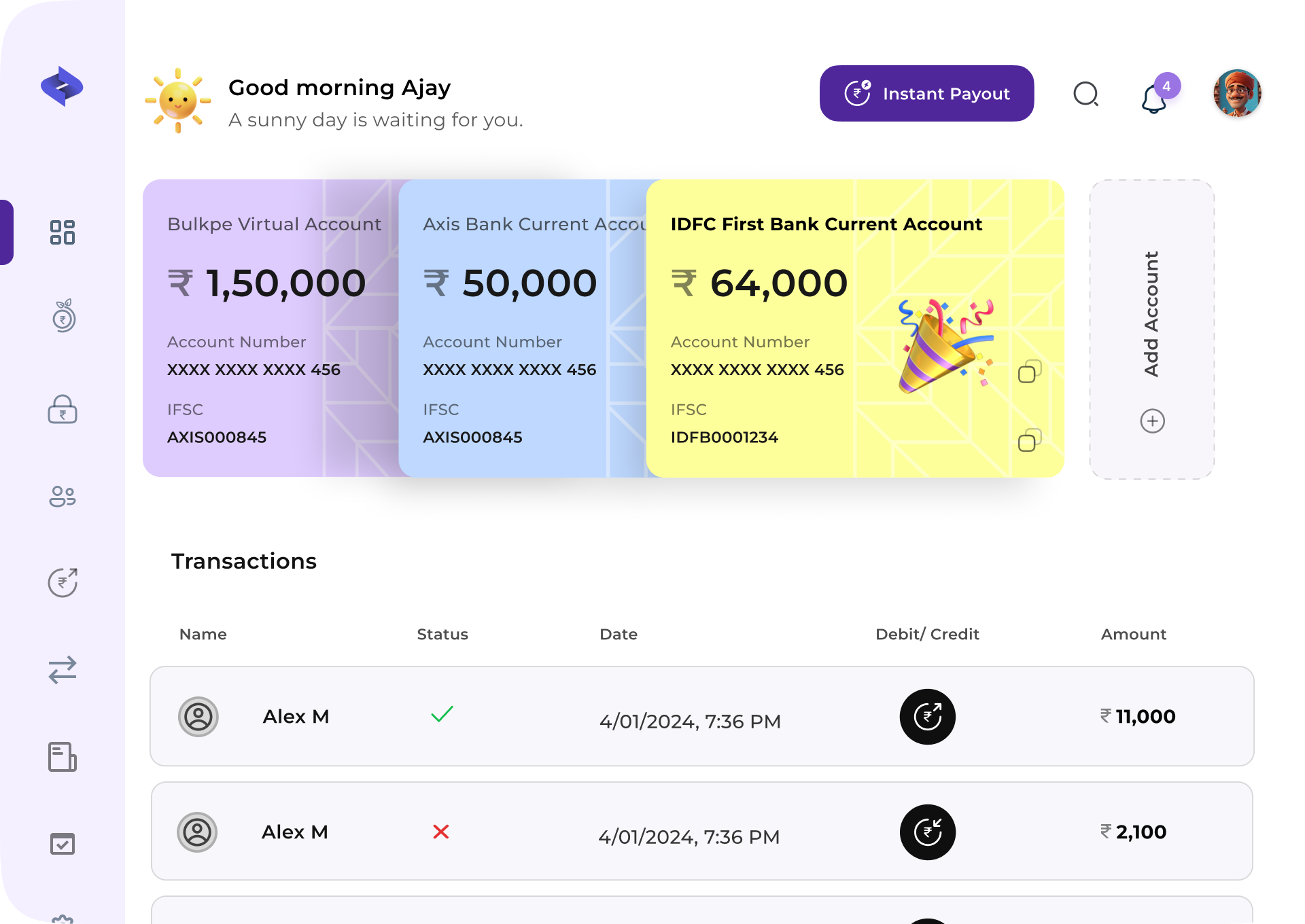

Bulkpe’s API for CRIF Report Access

For businesses and financial institutions, integrating credit report retrieval into your systems can improve efficiency. Bulkpe offers an API feature that simplifies this process.

- Fetch CRIF Credit Reports programmatically.

- Obtain up-to-date credit information instantly.

- Ensure data privacy and compliance with regulations.

- Suitable for businesses of all sizes.

Benefits for Businesses

- Cuts down manual work in checking credit details.

- Enables lending teams to make quicker and more informed decisions.

- Speeds up processing, so your customers doesn’t have to wait.

Sign up Now!

Thank you for choosing Bulkpe as your trusted payment partner. Your feedback, ideas, and questions help us grow, and we’re always here when you need us. Whether it’s support or just a quick chat, we’re only a click away.

Contact us?