In India’s financial system, staying compliant and preventing fraud is more important than ever. With businesses growing and transactions increasing, the risk of financial crimes is always around the corner.

Whether it’s opening a bank account, filing taxes, or making high-value transactions, PAN isn’t just another number, it’s what keeps things transparent and accountable.

The PAN or Permanent Account Number is an identity document issued by the income tax department for every citizen residing in India. From opening a bank account to investing in mutual funds, almost every transaction above a certain limit has to be authenticated by a PAN card. Moreover, your PAN card also acts as identity proof when required for different purposes of your daily life.

What is PAN Card Verification?

PAN card verification is a simple yet crucial process that ensures the authenticity of a PAN card. The Income Tax Department has authorized NSDL e-Governance Infrastructure Limited to issue and verify PAN cards. You can verify your PAN details online through the NSDL e-Gov service portal.

This verification helps determine whether a PAN card is valid, inactive, or deactivated. It also ensures that the PAN details match the official database and are not fraudulent or missing from government records.

Types of PAN Card Verification

File-Based PAN Verification :This method is used by government agencies and businesses that need to verify PAN details in bulk-typically 1,000 or more-by submitting a structured file as per Protean eGov Technologies’ guidelines.

Screen-Based PAN Verification :

Ideal for smaller verifications, this method allows up to five PAN cards to be verified at once through an online portal.

API-Based PAN Verification :

Monthly charges for advanced features and support.

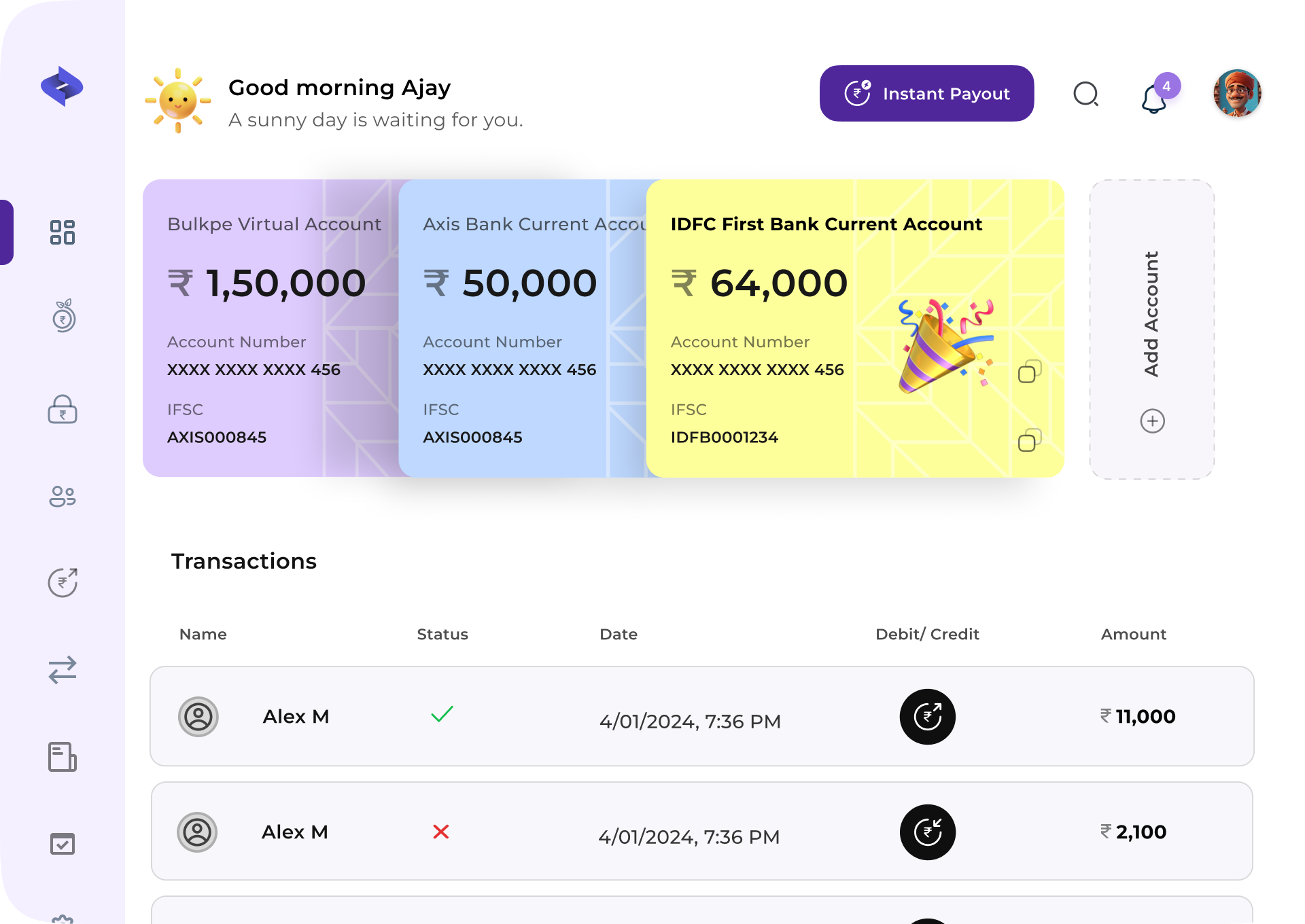

PAN Card Verification with Bulkpe :

Bulkpe offers efficient solutions for both individual and bulk PAN (Permanent Account Number) verifications, catering to diverse needs. With seamless API integration and bulk upload options, businesses can streamline compliance effortlessly.Individual PAN Verification :

✅ Sign Up or Log In in your Bulkpe account.✅ On your dashboard, select the 'Verification' section.

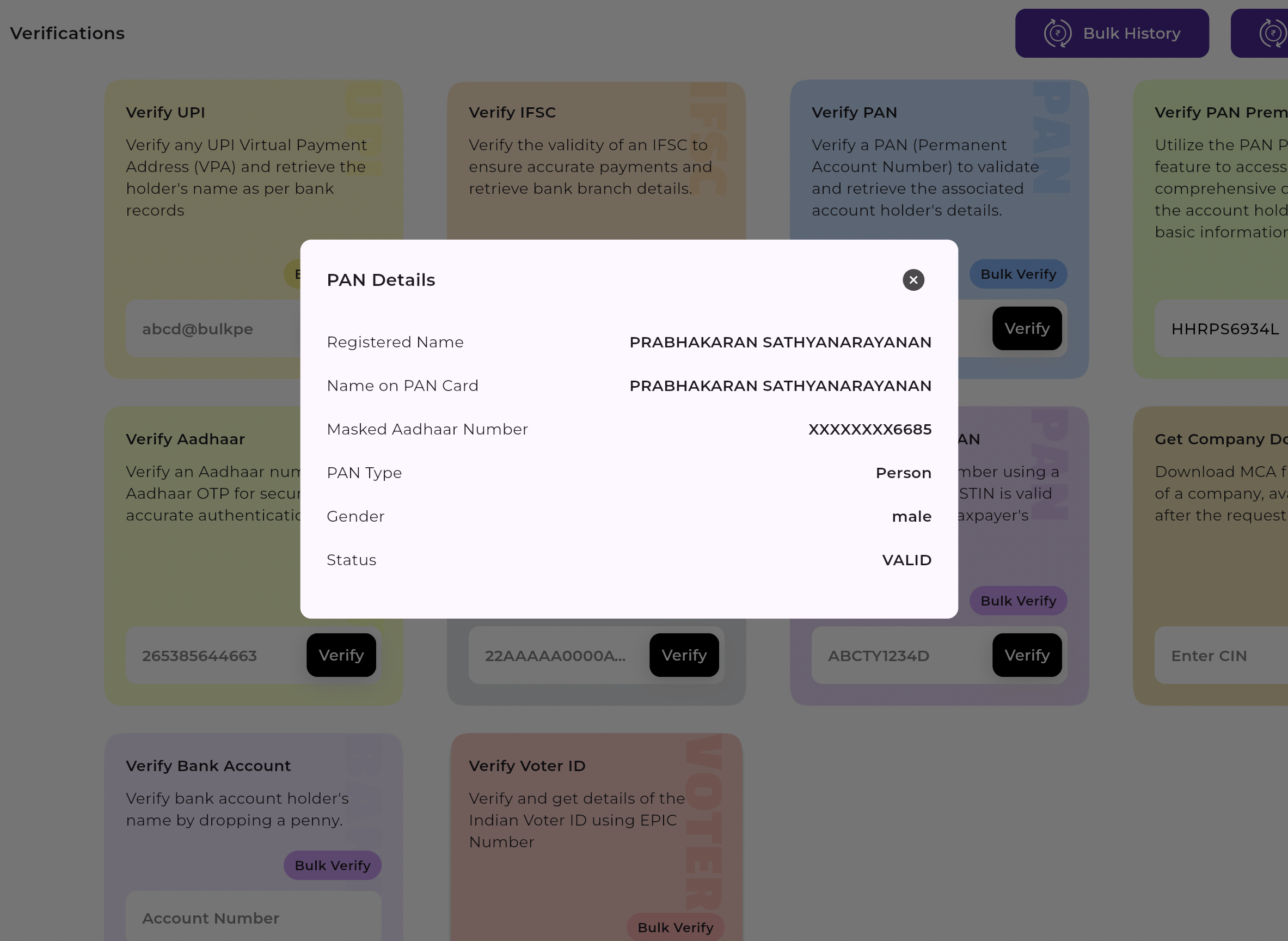

✅ Opt for 'PAN' or 'PAN Premium' based on the level of detail required.

✅ Enter PAN Details and initiate the verification process.

✅ The system will promptly display the verification outcome.

Sample result of pan verification from Bulkpe Dashboard

Bulk PAN Verification :

✅ On your dashboard, select the 'Verification' section.✅ Choose "Bulk Verify" in Pan verification

✅ Opt for 'PAN' or 'PAN Premium' based on the level of detail required.

✅ Initiate the bulk verification; the system will process all entries.

✅ After completion, download the verification results for your records.

Choosing the Right PAN Verification Partner for Your Business :

Selecting the right PAN verification partner is crucial for ensuring seamless compliance and secure transactions. Consider factors such as verification accuracy, processing speed, scalability, data security, and cost-effectiveness. A reliable partner should offer robust APIs, real-time verification, and compliance with regulatory standards. Additionally, staying updated on the latest advancements in PAN verification technology will help you choose a solution that aligns with your business needs and future growth.

Sign up Now!We truly value your trust in Bulkpe as your reliable banking partner and always look forward to hearing from you. Whether you have a question, feedback, or just want to connect, we’re here for you. Click the link below to reach out and let’s stay connected!

Talk to Bulkpe Sales