Offer seamless experience for your customers by introducing modern neobanking within your application. Power your business banking with the most advanced Digital Current Account APIs.

Let's Discuss

Instant account creation with Aadhaar-based verification.

Skip the hassle and open min KYC accounts effortlessly.

Built in partnership with NSDL Payments Bank.

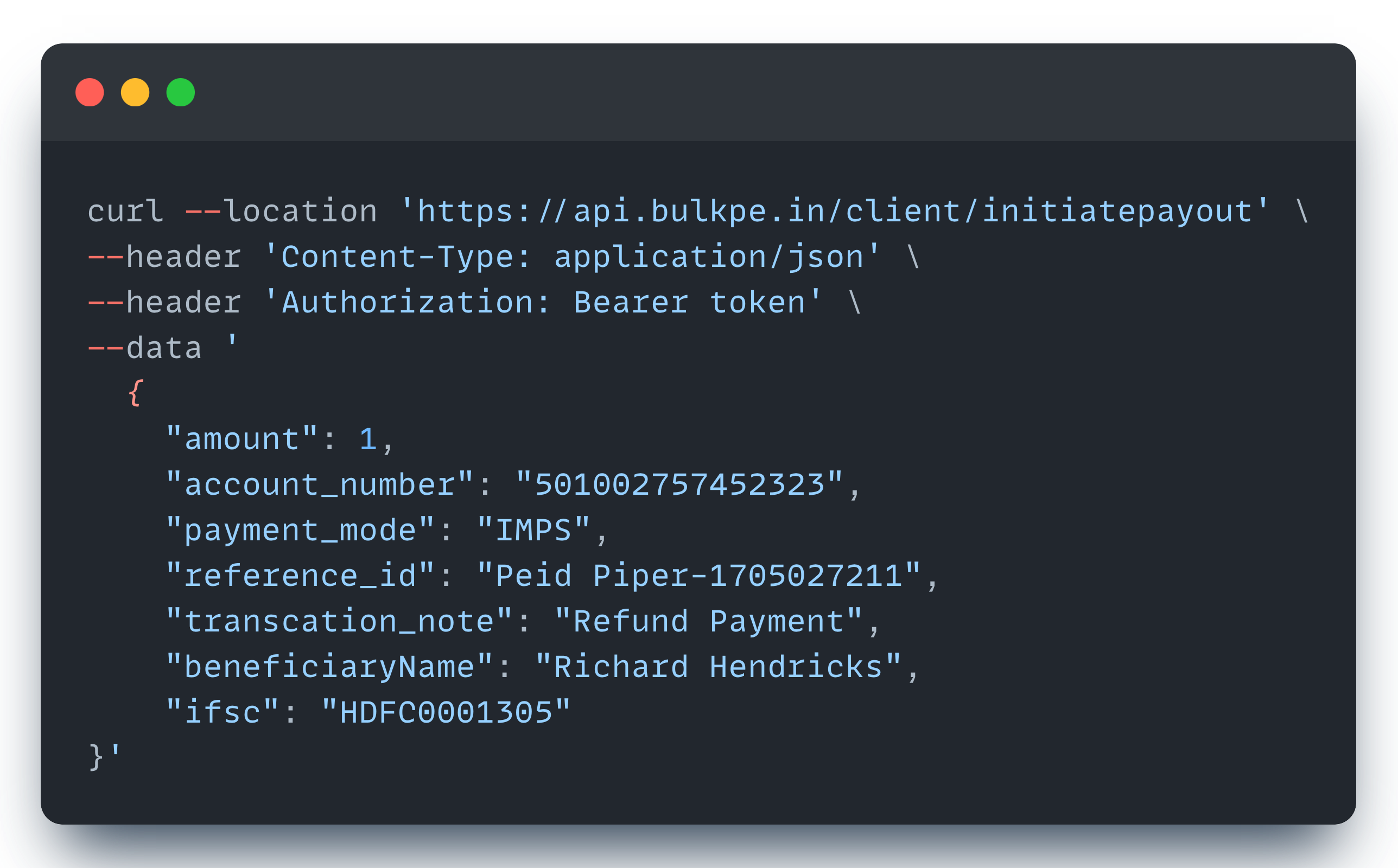

Fully integrated, developer-friendly APIs for automation.

Modern Neobanking in day to day life delivering an exceptional user experience.

Offer neobanking within your partner app. Enable real-time salary/wages for delivery partners, save 99% operational costs.

Offer advanced account opening and connected banking for your customers. Create mulitple use cases on top of it.

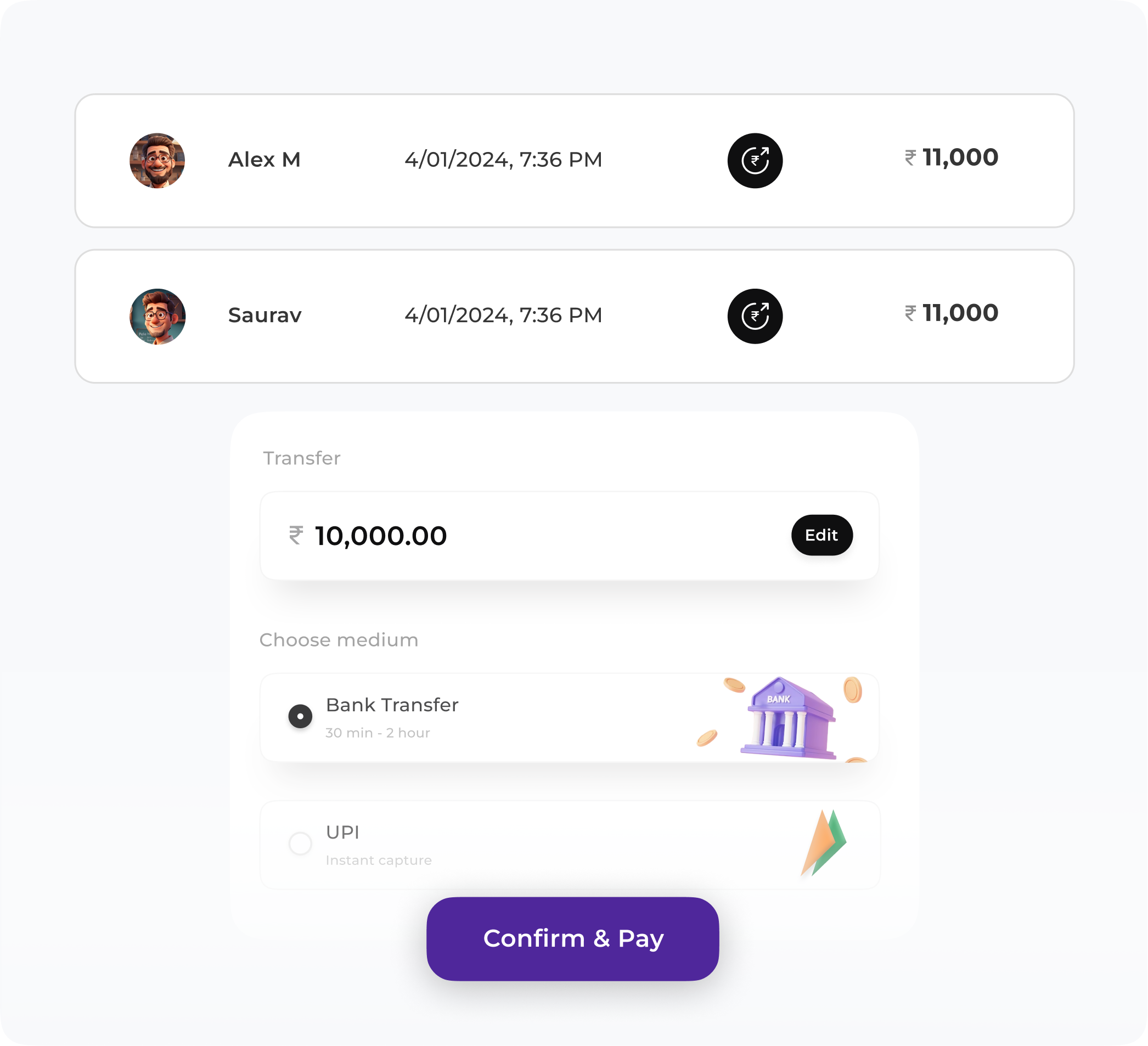

Automate loan disbursements and collections using standing instructions at a significantly lower cost than eNACH.

Optimize supply chain efficiency for labors, drivers, vendors and other stakeholders. Simplify payments and finance.

Simplify marketing collaborations and pay efficiently. Onboard gig workers and vendors with dedicated current accounts.

Embed banking features within your platform, enabling businesses to manage accounts, payouts, and collections seamlessly.

Signup and complete your digital KYC

Find our API Docs here and integrate in your system

Do test transactions and prepare for go live

Get your API token from our web app and go live

Yes, you can create multiple NSDL Account and manage using your single Bulkpe account via the API Stack.

Yes, OTP is mandatory. It is delivered to the NSDL account holder's registered mobile number and submitted in NSDL Redirection UI.

Yes, You will get a callback (webhook) for every credit and debit.