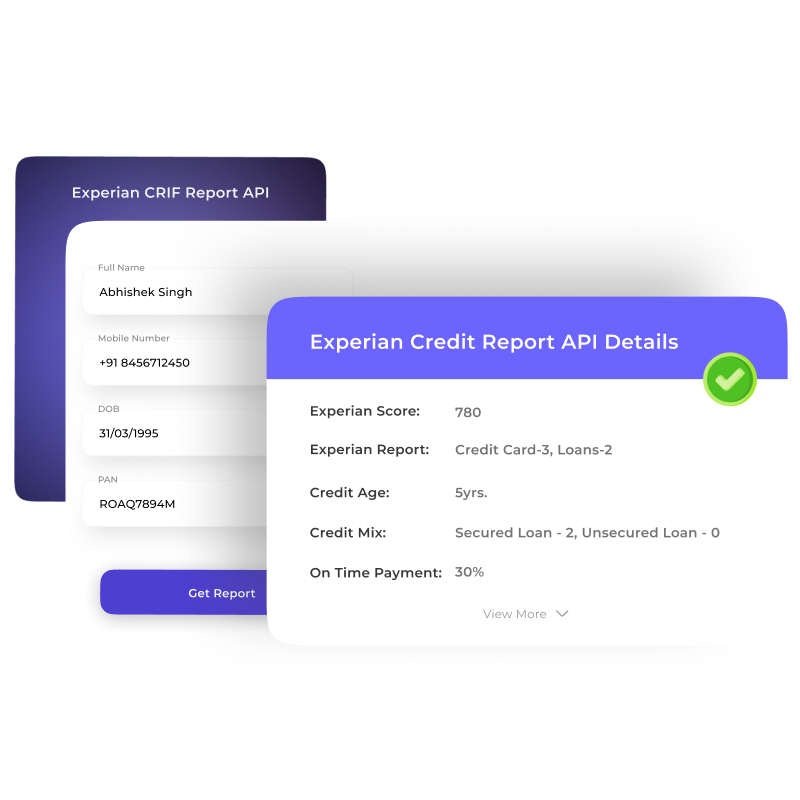

A reliable solution to verify borrowers using Experian’s complete credit profiles.

Reports are fetched in real time, usually within a few seconds.

You need the borrower’s PAN and phone number. These two details are mandatory to trigger an Experian fetch.

Yes. Bulkpe follows top-tier security and regulatory standards, ensuring encrypted, compliant data flow.

The Experian Credit Report API does not require webhook callbacks. Once your system sends a request for a report, Bulkpe provides an immediate API response with the complete credit report details.

Yes. Bulkpe’s unified APIs easily embed into your current loan workflow with minimal changes.