Open a Current Account with the third largest private sector bank in India. The Bank offers an entire spectrum of financial services to MSMEs.

Collect payments efficiently to your current account and UPI Static QR, Dynamic QR and other methods.

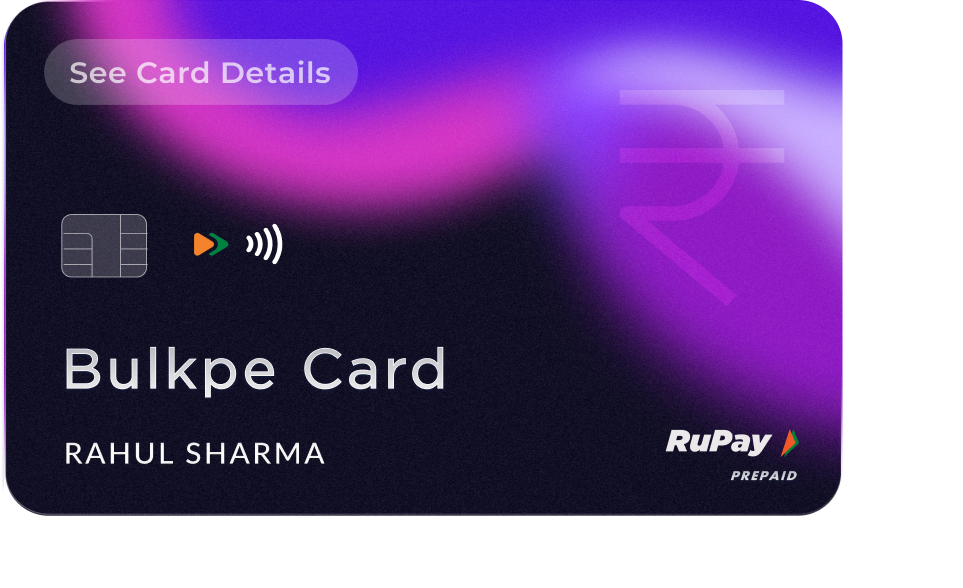

Make single and bulk payments easily using Bulkpe web dashbaord, Google Sheets, Mobile App and API.

Interest up to 9%. Make your money work for you, invest in Fixed Deposits and NBFC Deposit.

Get started in 2 easy steps - Singup and video KYC

UPI, IMPS, RTGS, NEFT. All four method don’t have any daily or monthly limit.

There's no per day limit like banks. However, there is an INR 1 lakh limit per transaction on UPI, INR 5 lakhs on IMPS, and no limit on NEFT and RTGS.

Open an account in a few minutes by verifying your aadhaar, pan card and business details.

As per RBI guidelines, It is mandatory to verify aadhaar and pan card to create a virtual / individual current account.

Yes, you can. Bulkpe has a sub virtual account feature where you can create individual virtual accounts for each branch, franchisee or business of yours. This will enable you to reconcile transactions easily, and be on top of money in and out.

Bulkpe is a web and mobile application that enables businesses to seamlessly manage money in and out. With Bulkpe, businesses can make bulk payout transactions in a few seconds, and collect payments from customers using UPI, QR, and Bank transfers. Bulkpe also enables businesses to create invoices that can be shared on WhatsApp or email in just one click along with a payment collection URL.