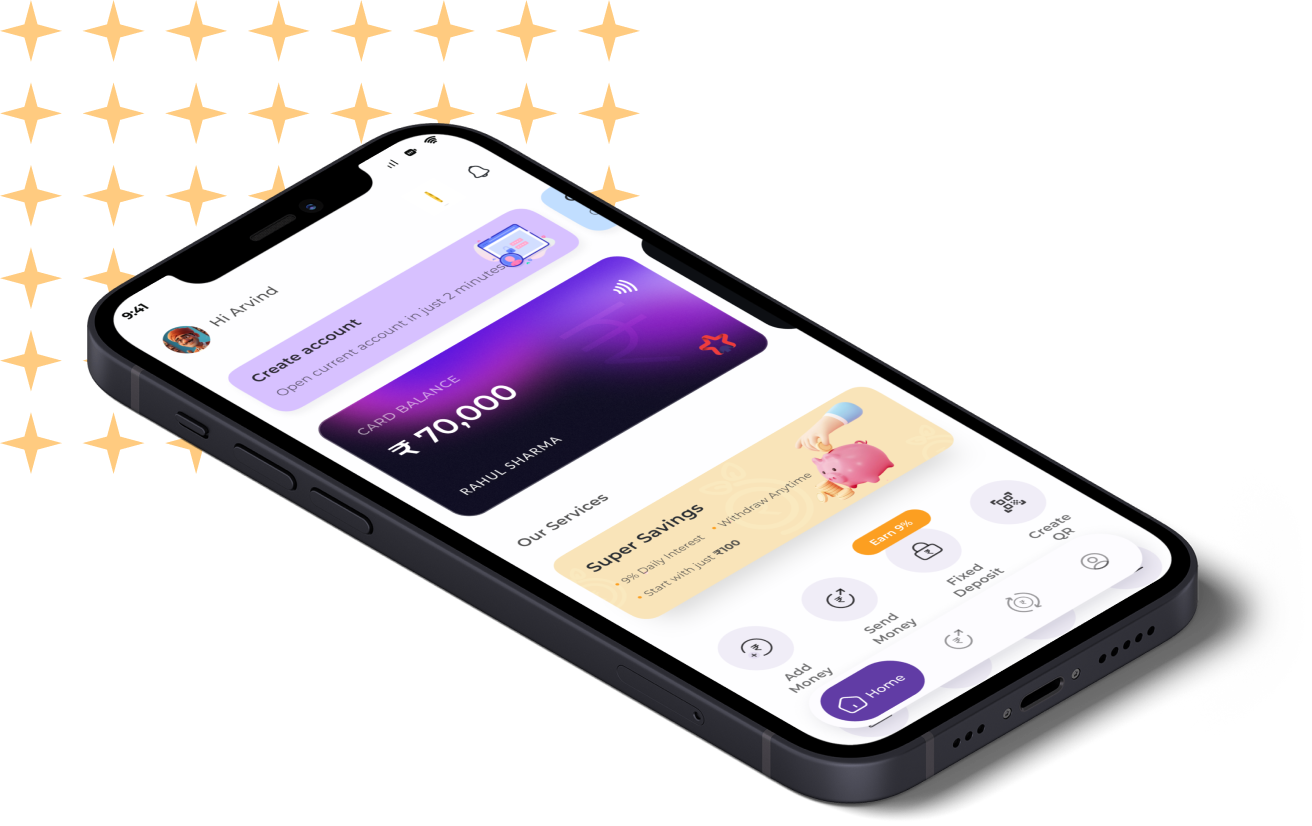

Experience superfast digital account opening with scheduled commercial bank

See live demo

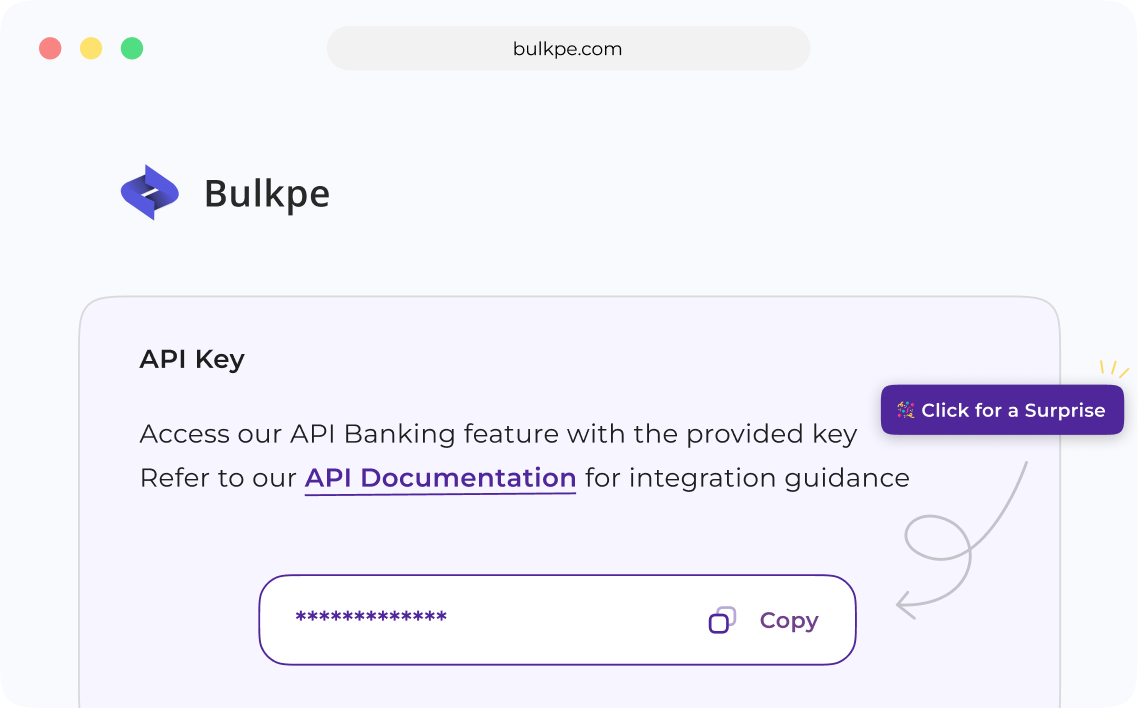

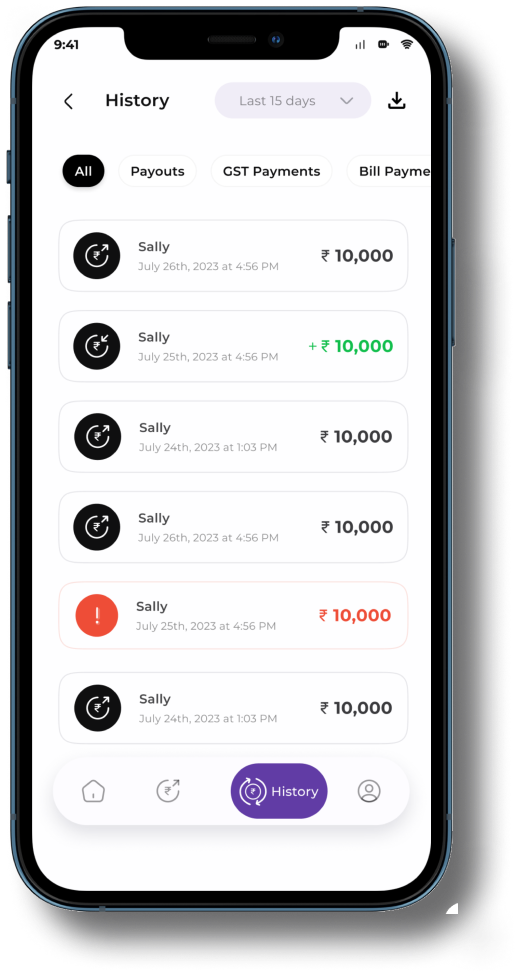

Web app, Mobile app, APIs and Integrations

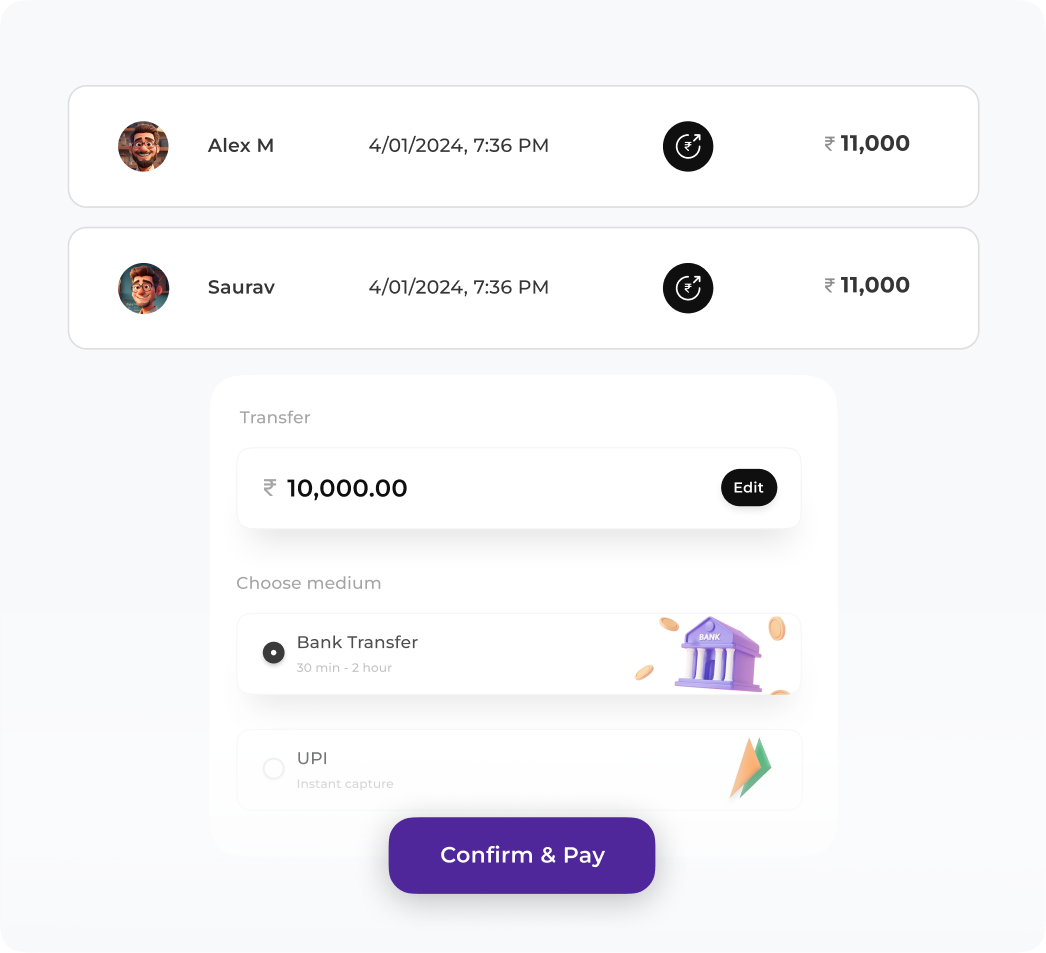

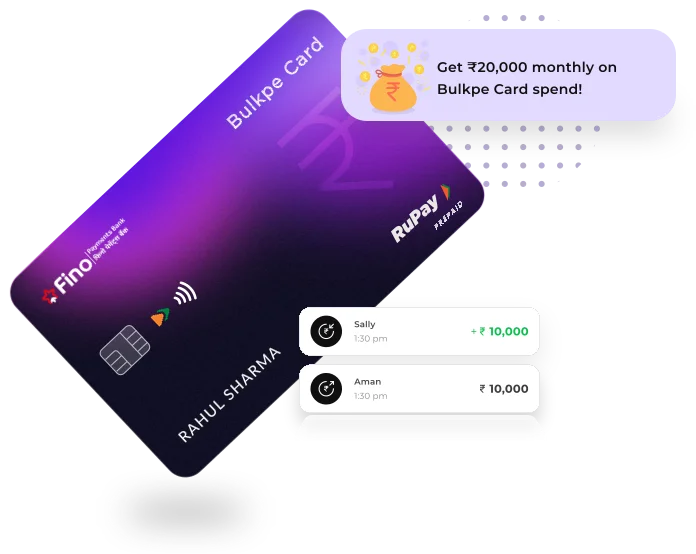

Use groups and tags to make superfast payments

Enjoy 24 * 7 on-the-fly payment without any limits

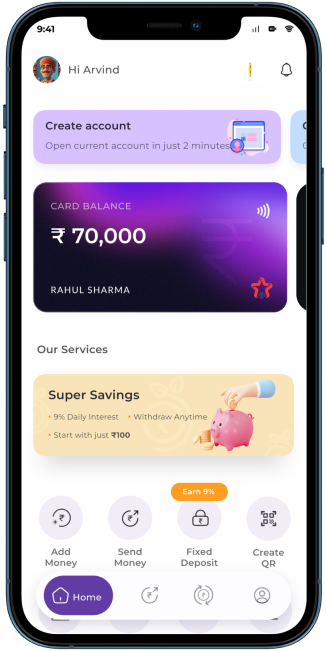

An account for all your financial needs

Empowering 63 million MSMEs to become financially aware of their business and have an end to end control over banking and payments that is easily accessible.

Are you a Large size FMCG, Fintech, Hyperlocal, F&B business, Multiple Branches, NBFC, Accounting Platform, Investment Platform, Mobile App, Wholesaler, Reseller, Marketplace, Ecommerce, SaaS, Payroll Management, Vendor Management, any other small business owner?

We can help you make your business payments frictionless just like how UPI apps did for your end customers.

UPI, IMPS, RTGS, NEFT. All four method don’t have any daily or monthly limit.

There's no per day limit like banks. However, there is an INR 1 lakh limit per transaction on UPI, INR 5 lakhs on IMPS, and no limit on NEFT and RTGS.

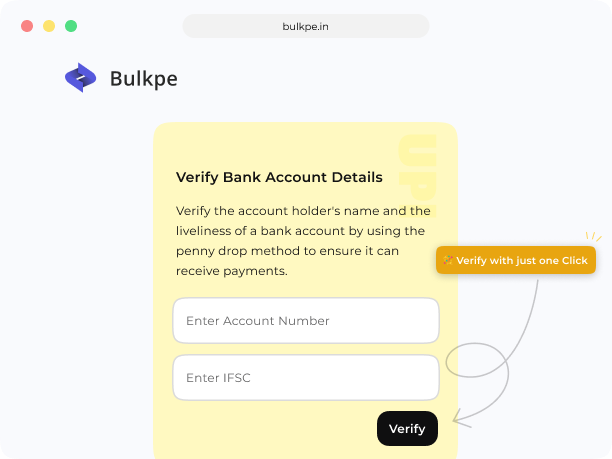

Open an account in a few minutes by verifying your aadhaar, pan card and business details.

As per RBI guidelines, It is mandatory to verify aadhaar and pan card to create a virtual / individual current account.

Yes, you can. Bulkpe has a sub virtual account feature where you can create individual virtual accounts for each branch, franchisee or business of yours. This will enable you to reconcile transactions easily, and be on top of money in and out.

Bulkpe is a web and mobile application that enables businesses to seamlessly manage money in and out. With Bulkpe, businesses can make bulk payout transactions in a few seconds, and collect payments from customers using UPI, QR, and Bank transfers. Bulkpe also enables businesses to create invoices that can be shared on WhatsApp or email in just one click along with a payment collection URL.