As India transitions from paper-based payments to digital platforms, online fraud is also growing quickly and becoming more advanced. In the first 10 months of FY 2024‑25 (April - January), India recorded 2.4 million digital fraud incidents, resulting in losses totaling ₹4,245 crore, a 67% jump from the previous year’s across 2 million cases.

To avoid falling prey to these frauds, business must update themselves with real-time solutions for verifying bank accounts before making payouts or transferring money else were. And one such solution is Reverse Penny Drop, a UPI-based authentication method designed any type of businesses. This blog explores what it is, why it important for your business, and how you can leverage it with Bulkpe's API.

What is Reverse Penny Drop?

Reverse Penny Drop is a UPI-based authentication method which lets users verify their account by making a ₹1 payment. Once verified, the amount is immediately reversed back to the users account.

Here’s how it works:

1️. The user provides their UPI ID or VPA (Virtual Payment Address).

2️. A UPI collect request is sent to the user.

3️. Once the user accepts the request, the system confirms their account validity and identity.

This simple interaction allows businesses to authenticate users instantly, without transferring any funds or requiring additional paperwork. It eliminates friction and provides a more secure and modern way to verify financial identities.

Why Reverse Penny Drop is a Game Changer?

Reverse Penny Drop offers several advantages over the verification methods we normally use, particularly for businesses operating in the BFSI and NBFC sector:

1️⃣ Real-Time Verification

Because the system relies on UPI infrastructure, it works round the clock with no dependency on banking hours or manual reviews.

2️⃣ 24/7 Availability

Since the verification is done directly with user participation, the chance of fake or incorrect bank account details is very less.

3️⃣ Reduced Fraud Risk

Since the verification is done directly with user participation, the chance of fake or incorrect bank account details is very less.

4️⃣ Ideal for Onboarding at Scale

Whether you're onboarding merchants, agents, customers, or gig workers, this method reduces operational burden and accelerates go-live timelines.

How to Use Reverse Penny Drop with Bulkpe API?

Bulkpe’s API makes it easy to integrate Reverse Penny Drop into your existing systems. Here's how businesses can get started:

Verifying bank accounts is easy and secure with Bulkpe. Here's how it works:

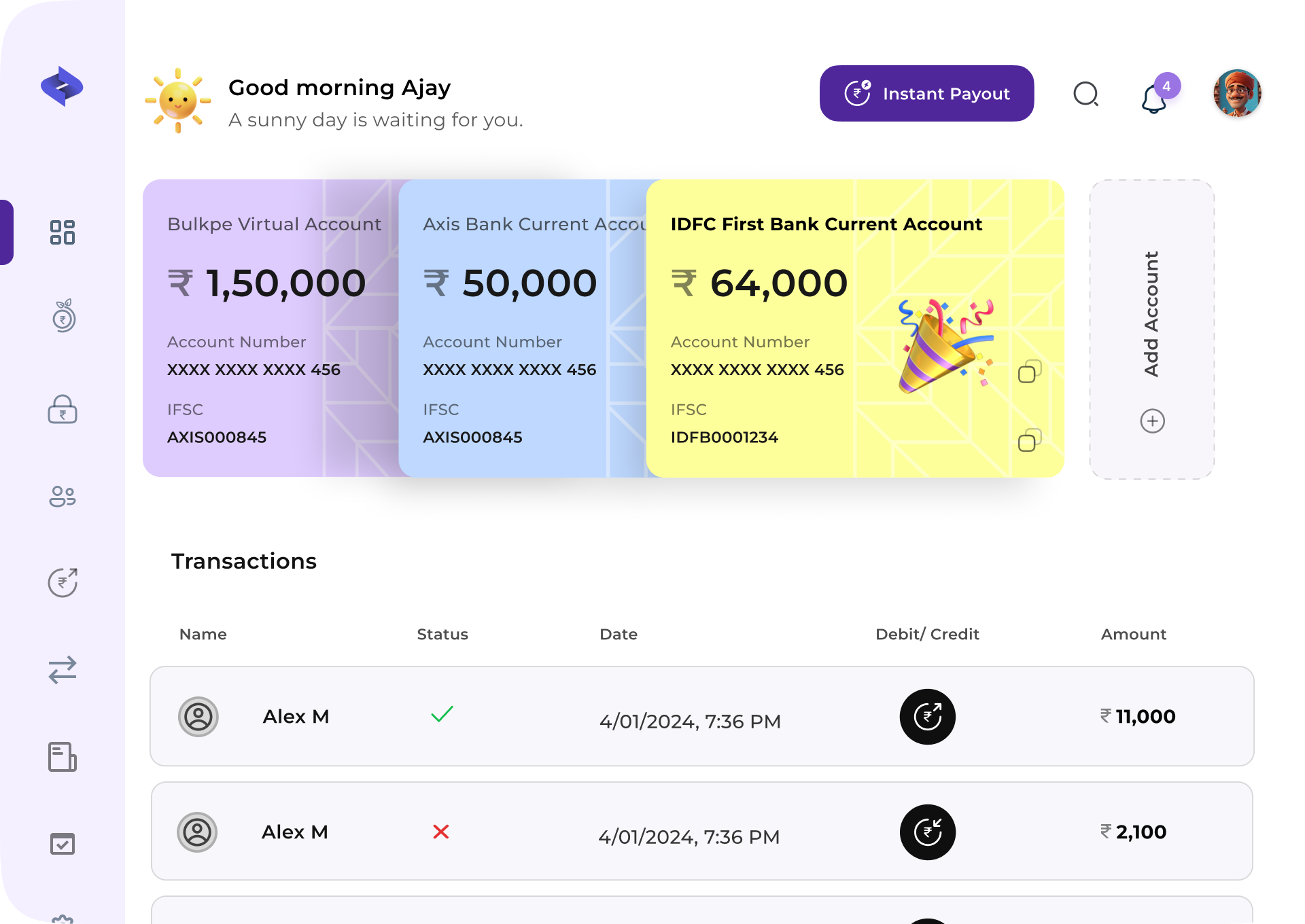

1️⃣ Sign up on Bulkpe and get access to your API credentials via the dashboard.

2️⃣ Create a payment collection request to the user with their UPI VPA.

3️⃣ Once the user approves the request, Bulkpe verifies the account holder's name, account number, and IFSC.

4️⃣ Get instant results with the account holder’s name and other details. This helps you confirm that the UPI ID is valid and linked to the right individual.

Once verified, you can make payments with confidence that money goes to the right account.

Reverse Penny drop verification is not just an upgrade to your business. It is a fundamental shift in how businesses verify financial identities. In a world where speed, security, and scale matter, this feature offers a smarter way to verify bank accounts.

For companies in the BFSI sector, adopting this method with Bulkpe’s robust API can significantly Increase user trust, reduce verification time, and cut down operational costs. If you are building digital journeys that demand seamless onboarding and real-time verification, it is time to move forward with Reverse Penny Drop.

Sign up Now!

We sincerely appreciate your trust in Bulkpe as your banking partner. Your feedback, questions, and ideas matter to us - and we’re always just a click away. Whether you need support or simply want to connect, we’re here for you.

Contact us?