If you're running an NBFC, you know the real struggle isn't lending, it's getting the money back.

Traditional repayment methods are outdated and slowing down growth. Manual follow-ups, Excel tracking, and scattered reconciliation systems can’t keep up with a growing lending environment. Missed EMIs, payment bounces, and fragmented processes eat into profits and disrupt cash flow.

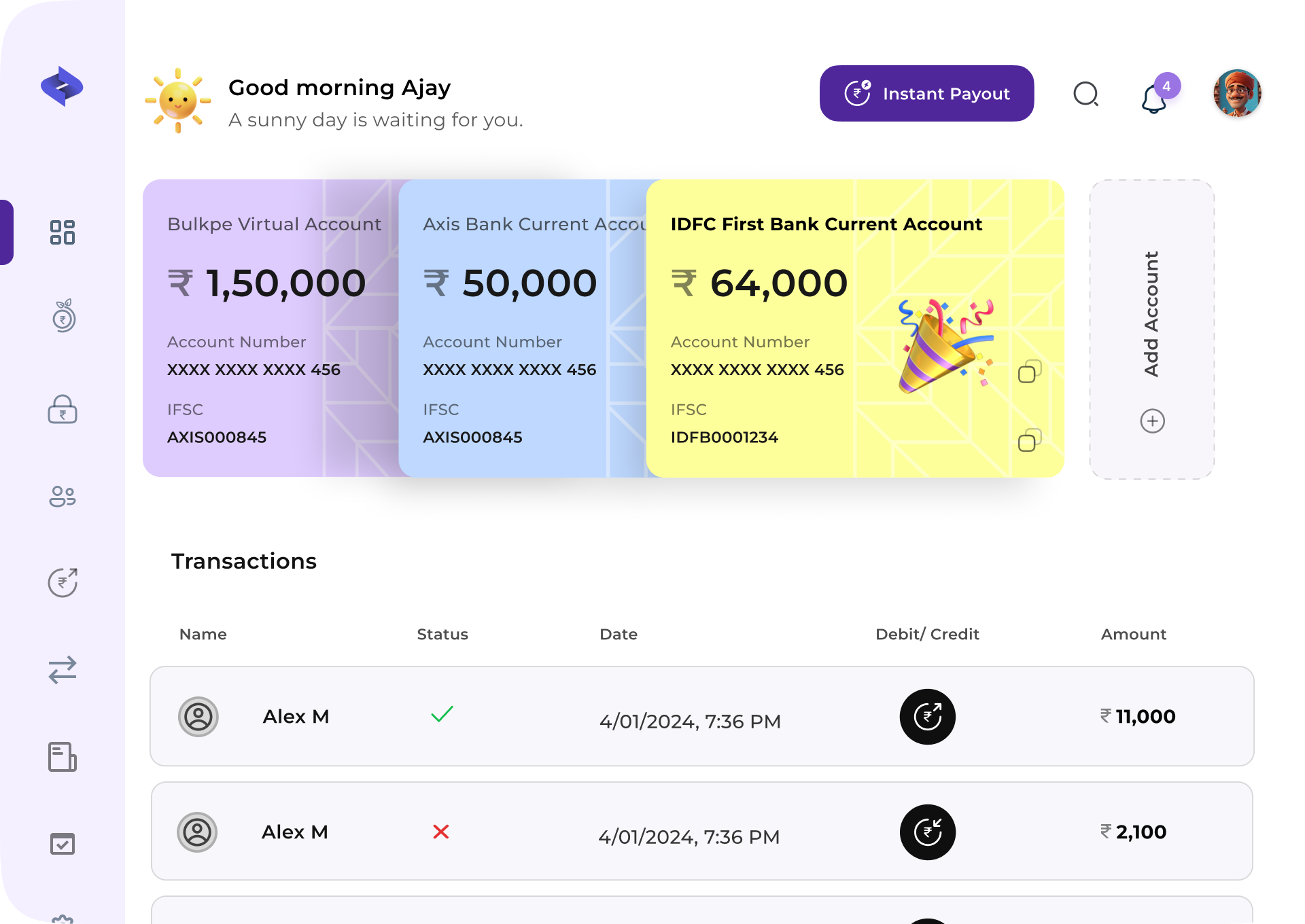

That’s why leading NBFCs are moving toward automated, API-driven collection systems and that’s exactly where Bulkpe’s Collections steps in.

Meet Arjun: Co-founder of a small NBFC

Arjun runs a mid-sized NBFC with 10,000 active borrowers across 6 states. A few months ago, his collection team was buried in calls, reminders, and manual payment tracking. Failed EMIs meant delayed cash flow, and reconciling transactions across multiple banks was a weekly nightmare.

Today, collections happen automatically. Payments arrive on time, reconciliation happens instantly, and Arjun’s team finally focuses on growth instead of chasing repayments.

Here’s how he transformed his collections with Bulkpe.

Step 1: Collect Smarter, Not Harder

With Bulkpe, Arjun can choose how he wants to collect by creating static QRs for fixed accounts, dynamic QRs that auto-generate for every transaction, or Payment links that can be shared instantly.Flexible Collection Options

Static VPA

Assign permanent Virtual Payment Addresses (VPAs) to each customer for recurring payments like EMIs. Track incoming payments in real time without manual mapping.Dynamic VPA

Generate unique VPAs for every transaction with pre-set amounts and expiry times.Payment Gateway Links

Send branded, secure payment links through SMS, email, or WhatsApp. Borrowers can complete payments instantly using UPI, cards, or net banking, no app integration required.With these tools, Arjun’s customers pay in seconds, and every transaction maps automatically to the right account.

Step 2: Validate Before Disbursing

Earlier, Arjun’s bounce rates were high because of incorrect or inactive bank details. With Bulkpe’s Bank Account Verification APIs, every borrower’s account is validated before disbursement, reducing payment bounces and manual follow-ups. This ensures clean data, accurate payouts, and zero wasted time.

Step 3: Automate Repayments at Scale

Customers who once forgot their payment dates now pay on time with Bulkpe’s automated UPI collect requests and scheduled reminders, ensuring EMIs are never missed.Arjun’s collection costs dropped by 80%, and his team now handles five times more borrowers without increasing the manpower.

Step 4: Monitor and Reconcile

Every transaction is visible in a single dashboard. Bulkpe automatically matches payments with customers and updates statuses across all connected banks in real time.With automated reconciliation and detailed reports, audits are faster, and financial accuracy stays intact.

As results,

- 50% fewer failed payments

- 40% faster collection cycles

- 30% lower operational costs

Your customers expect quick, convenient and digital payment experience. With Bulkpe, you can do the same.

Why Bulkpe?

Bulkpe’s Collection is built for modern NBFCs to help you move from manual reconciliation and collection hassles to fully automated collections.- Collect through Static QR, Dynamic QR, or Payment links

- Auto-reconcile across multiple banks

- Scale seamlessly with APIs built to handle volume

If collections are slowing you down, it’s time to move to a solution built for scale. With Bulkpe, you collect better, faster, and all from a single powerful dashboard because growth shouldn’t be held back by how you collect your money.

Thank you for choosing Bulkpe as your trusted payment partner. Your feedback, ideas, and questions help us grow, and we’re always here when you need us. Whether it’s support or just a quick chat, we’re only a click away.

Connect with Us