Origin of Bulkpe

We started Bulkpe in 2022 as a part-time startup exploration while working our full-time jobs. We began with two goals -> (1) Make it 10x easier to manage business banking and payments. (2) Build a startup or more accurately, a small, focused team where we can work on interesting projects, with interesting people, while leading interesting lives.

This blog post serves three purposes. First, as Bulkpe started to grow rapidly, this post serves as a reminder and guide for us and the new people joining our team. Second, to help our customers and potential customers understand the kind of company they’re engaging with, giving them more comfort and confidence in their decision. Third, in the interest of learning, forcing ourselves to improve, and being transparent, we’re publishing this as a public blog post.

Here’s what we’ll cover at a broad level,- Why Bulkpe exists

- What we do at Bulkpe

- How we work

Why Bulkpe Exists?

We started with a mission to simplify and make it 10x easier to manage end-to-end banking and payments for businesses in India. We believe every business is significantly empowered when partnered with the right people especially partners who help manage their finances. That’s where we aim to step in, acting as changemakers to help businesses grow.

India has been at the forefront of innovation in banking, but innovation in business banking has lagged behind. Large banks focus on serving the top 5% of businesses, where they receive large deposits, convert them into loans, and generate profits. While this is a valid model, we observed a few long-term problems: (1) Banks prioritize larger businesses. (2) Innovation is not happening fast enough. (3) Solutions are not easily accessible. (4) Banks primarily offer standard products (such as, deposits and loans) without developing advanced or tailored byproducts. We believe a transformational wave in banking is inevitable, and the next one will likely occur by 2030.

From a business owner’s perspective, many are stuck using outdated net banking systems that fail to meet their daily operational needs. The UPI wave demonstrated the potential of technology for Indian businesses, but products remain fragmented, with no single source for integrated information and control. We realized the need to create a platform that enables business owners regardless of size, technical capability, or industry to manage their end-to-end banking effortlessly. This platform should provide access to comprehensive banking products, seamless accounting, team collaboration, data sharing with accountants, and API-based banking for tech companies - all under one roof. Built for the businesses of the future.

In simple terms, our goal is to make world-class banking, payments, and accounting solutions accessible to every business.What We Do at Bulkpe?

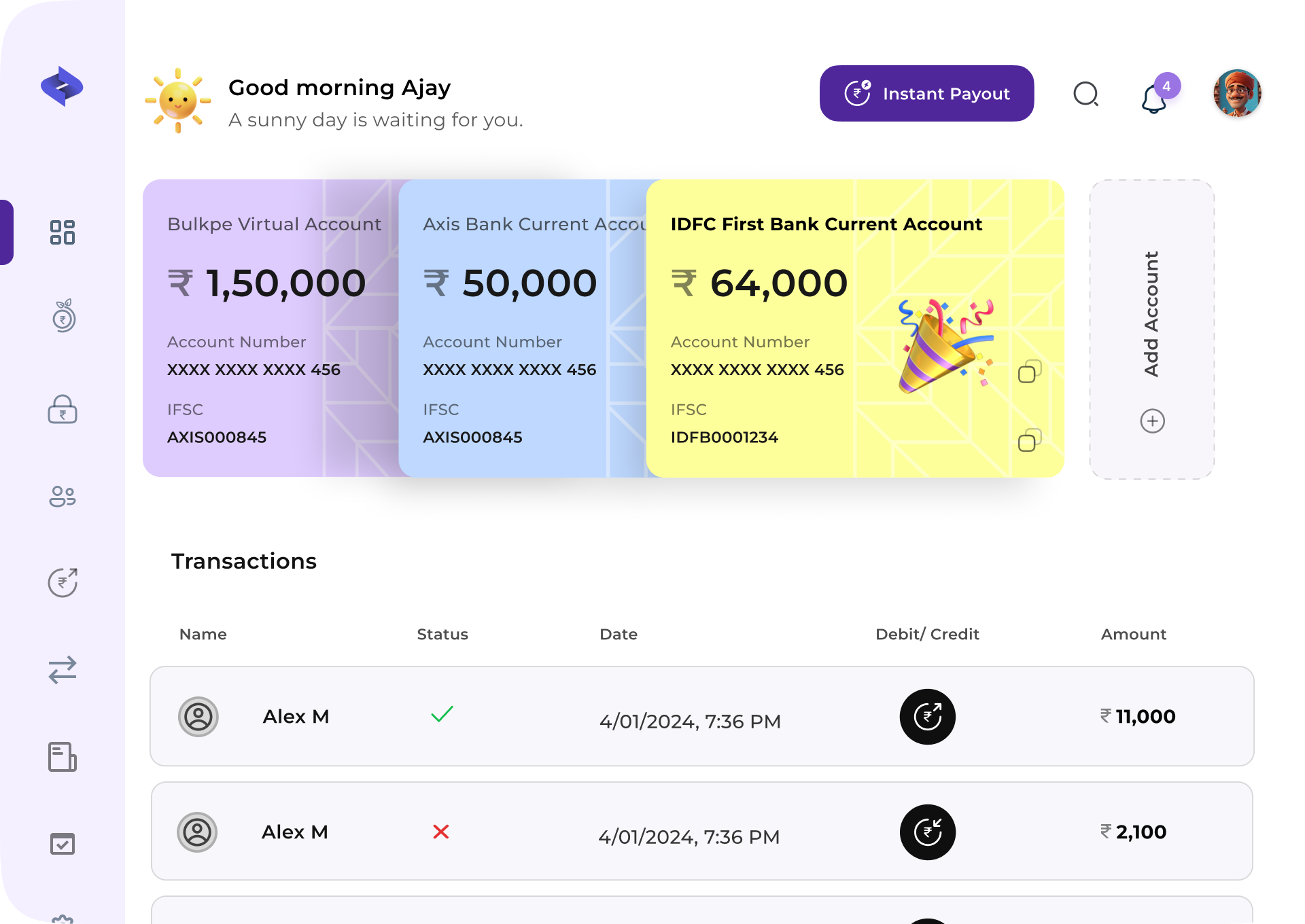

As of 2024, the main products we’ve built and continue building include:

1. Bank Accounts

Every business requires a bank account to function. We offer the ability to open a business current account through a seamless journey. For sole proprietors and individual business owners, we provide an instant current account that can be opened in less than two minutes. For other business types (e.g., Private Limited, LLP, Partnership), we combine digital and physical processes to comply with regulations. Once the account is opened, it can be managed entirely through the Bulkpe web and mobile applications from viewing balances and making payments to pulling statements.

For businesses managing third-party funds, Bulkpe also offers Escrow Accounts, Non-Operative Current Accounts, and Virtual Accounts. Businesses like e-commerce marketplace, and real estate are some examples who require this.

2. Payment Collection and Payouts

Collecting money and making payments are core to business operations. We provide various solutions for seamless management, including web and mobile apps, Google Sheets integration, bulk file uploads, APIs, and more. All the different kind of payments can be tracked on a single dashboard, unlike traditional systems that require separate portals for collections, payouts and so on.

3. Bulk Bill Payments

We help businesses focus on their core activities by automating payments for utilities like electricity, rent, water, mobile recharges, internet, and 30+ other recurring payments. A business with mutliple branches can really take use of this, managing things at scale.

4. Virtual Accounts

VAs act as wallets and ledgers for various use cases, enabling payment collection, storage of money, and payouts. They simplify managing multiple stores, cost centers, petty cash and many other use cases.

5. Verification Suite

Verification is critical when onboarding users or vendors. Our suite includes 70+ APIs for tasks like bank account verification, PAN verification, GST verification, and more.

6. Bulkpe Card

In partnership with Fino Payments Bank, we offer prepaid cards for managing employee expenses and cash requirements.

7. Fixed Deposits

Monetizing surplus funds and investing for long term should be simple. We provide fully digital fixed deposits for earning interest seamlessly. We’re also developing overnight deposit options for short-term liquidity with interest.

8. Loans and Credit Cards

Access to credit is essential for any business. We’ve partnered with 50+ banks and NBFCs to provide business loans and credit cards.

Over the past 18 months, a team of nine has built these eight core products, and we are rapidly creating additional byproducts to deliver seamless banking under one roof.

How We Work

We set weekly goals and strive to achieve them within the week. Each team member takes ownership of specific tasks and manages them end-to-end. If Elon Musk were to ask, “What did you get done this week?” (reference) every team member at Bulkpe would have a list of accomplishments.

We avoid preset meetings, managing everything via chat and Notion. Our guiding principles ensure alignment:

- Bias towards action: We believe that continuous action is the key to progress.

- Own Your Work: Don’t wait for others; if you see a problem, and you can fix it - fix it yourself.

- Keep your word: If for any reason you can’t, provide a valid explanation.

- Work hard and harder: Set an example. Nothing revolutionary was built without great effort.

- Take ownership: Be 100% responsible for your actions and their outcomes.

- Think big, act step by step: Plan for the next 10 years, but execute with a weekly focus.

- Credit goes to action, not plans: You earn recognition by doing, not just preparing.

- Eat your own dog food: Inspired from Google - Use our products every day. If it sucks, make it better.

- Make swift decisions: Act fast on decisions that can be reversed. Be careful with those that can’t.

- Find joy in action: The greatest satisfaction comes from realizing you've done something today that you couldn’t do yesterday.

Moving Forward

With these virtues and our dedicated team, Bulkpe has grown to serve 6,000+ businesses, processing ₹125+ crores in payments daily (as of October 2024). We are committed to crafting world-class experiences for entrepreneurs and business owners across India.

If you have any questions or thoughts to share, feel free to reach us at [email protected].

Would love to hear from you!