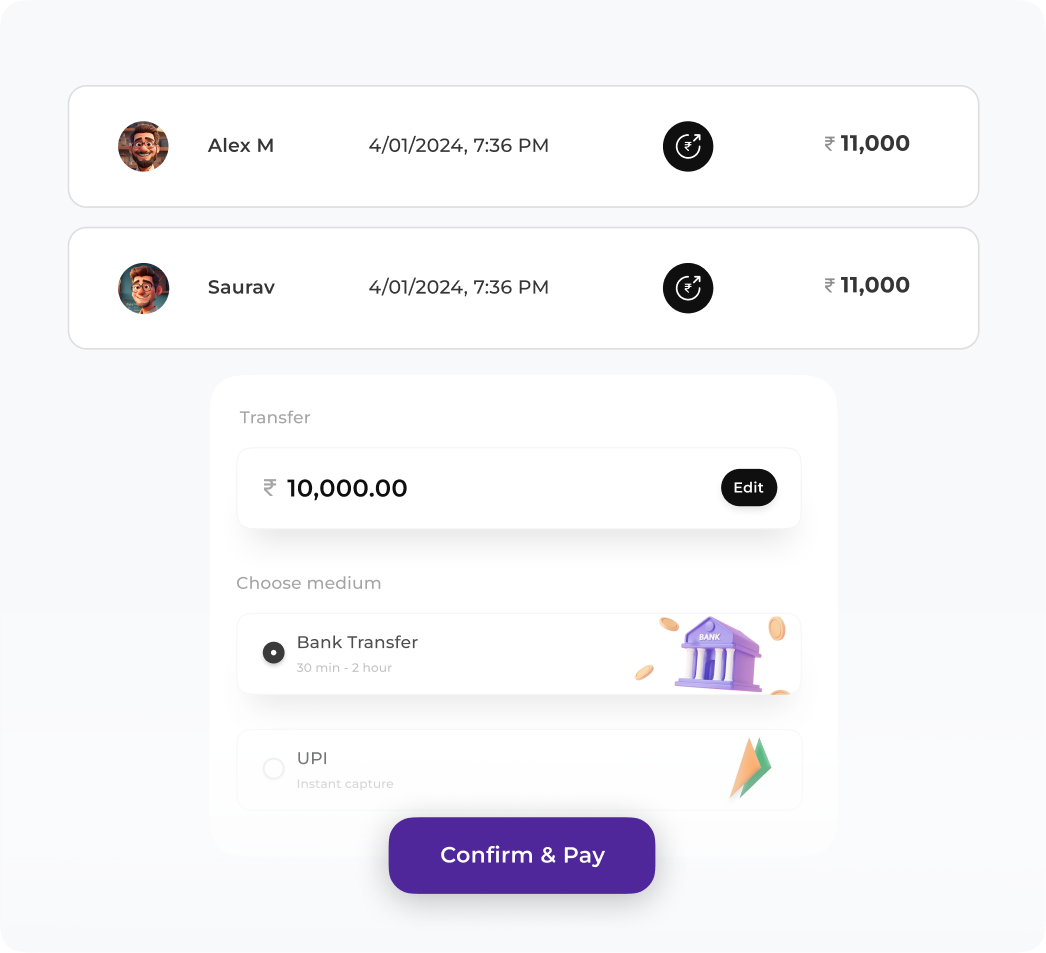

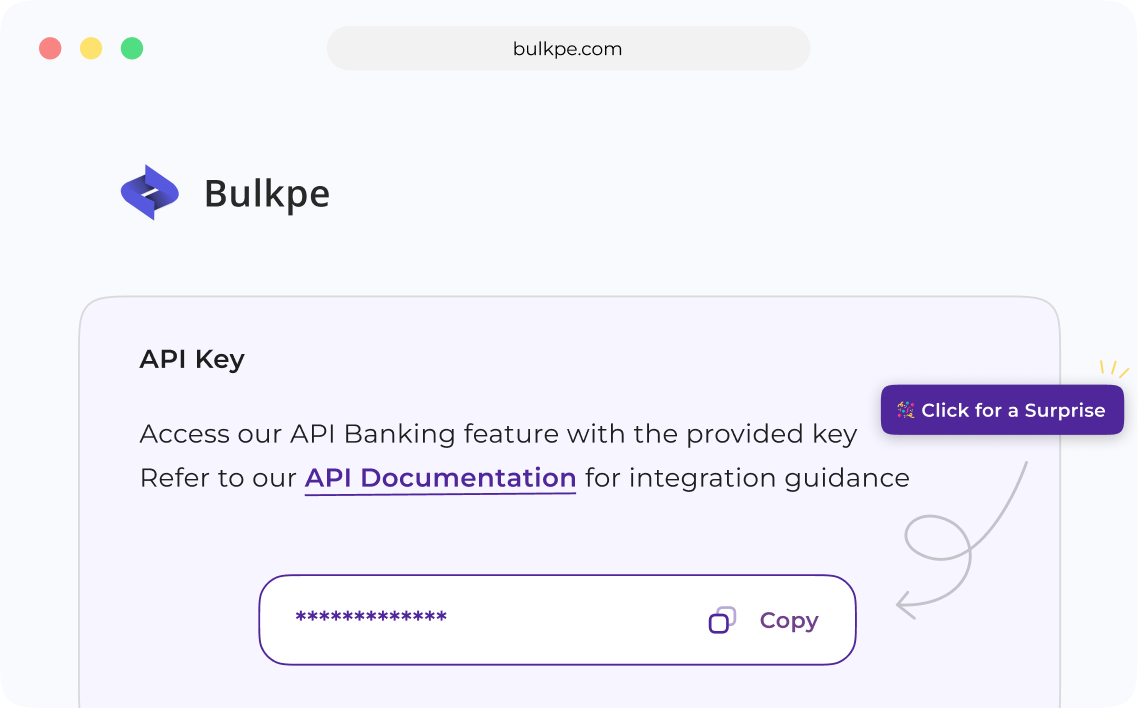

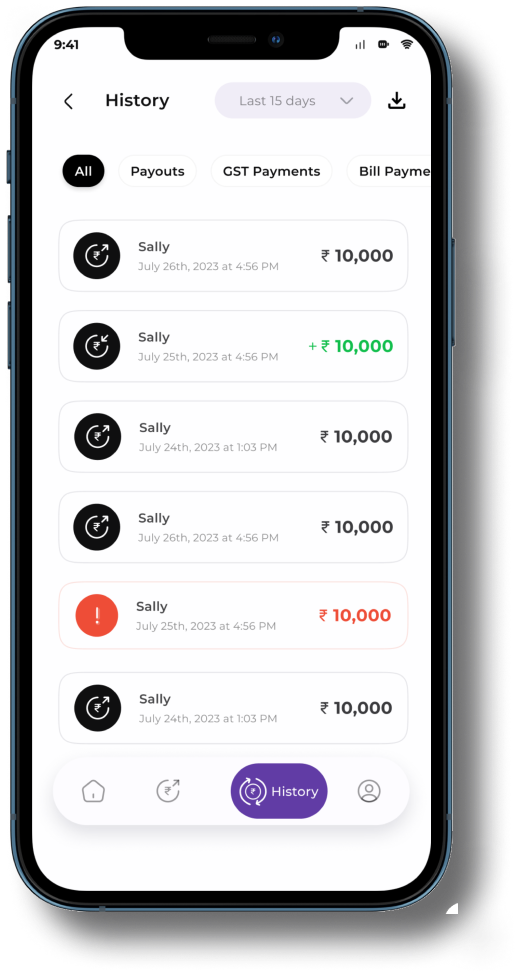

Instantly and securely send payouts to bank accounts and UPI IDs using APIs, dashboards, and file uploads.

Signup Now

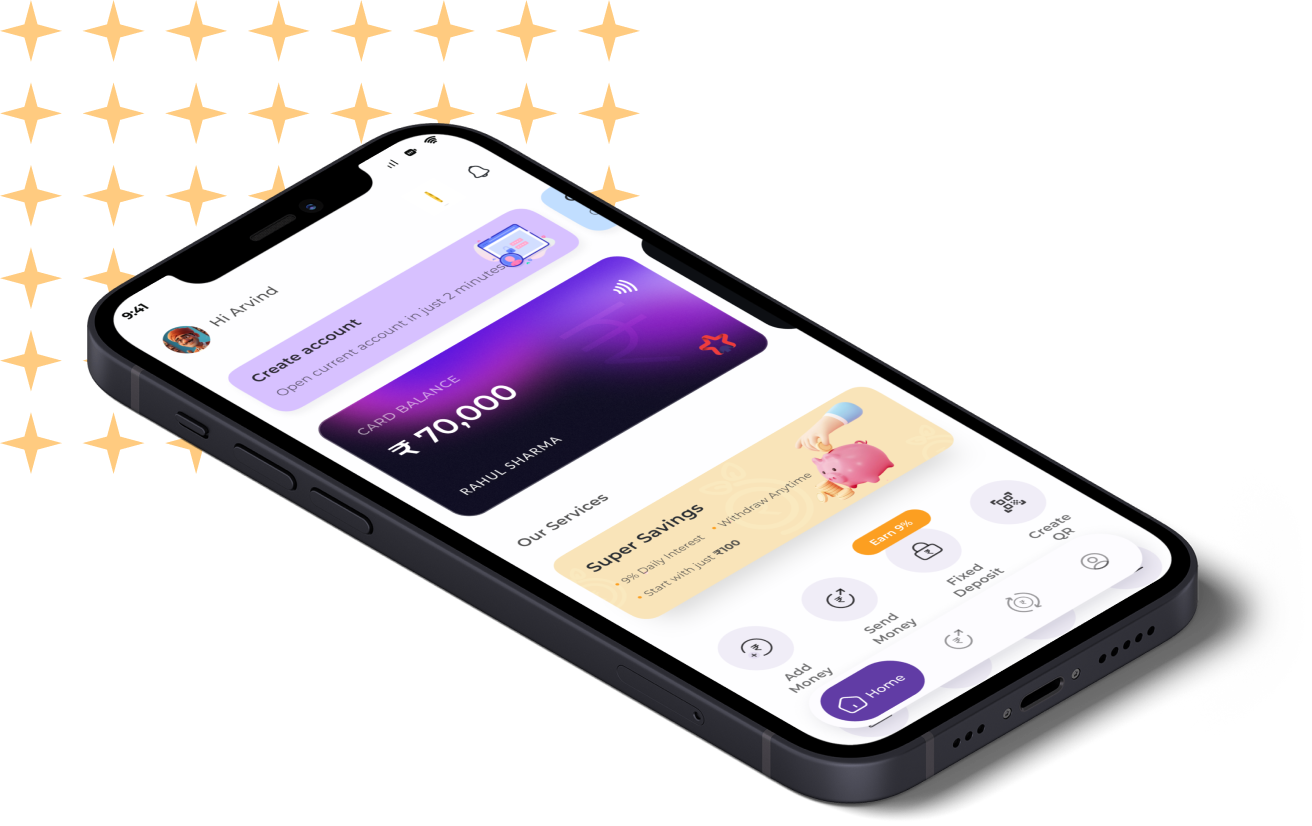

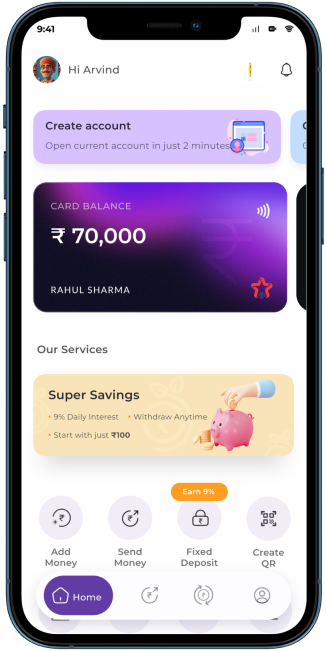

Web app, Mobile app, APIs and Integrations

Upload Excel file to process payouts

Enjoy 24 * 7 on-the-fly payment without any limits

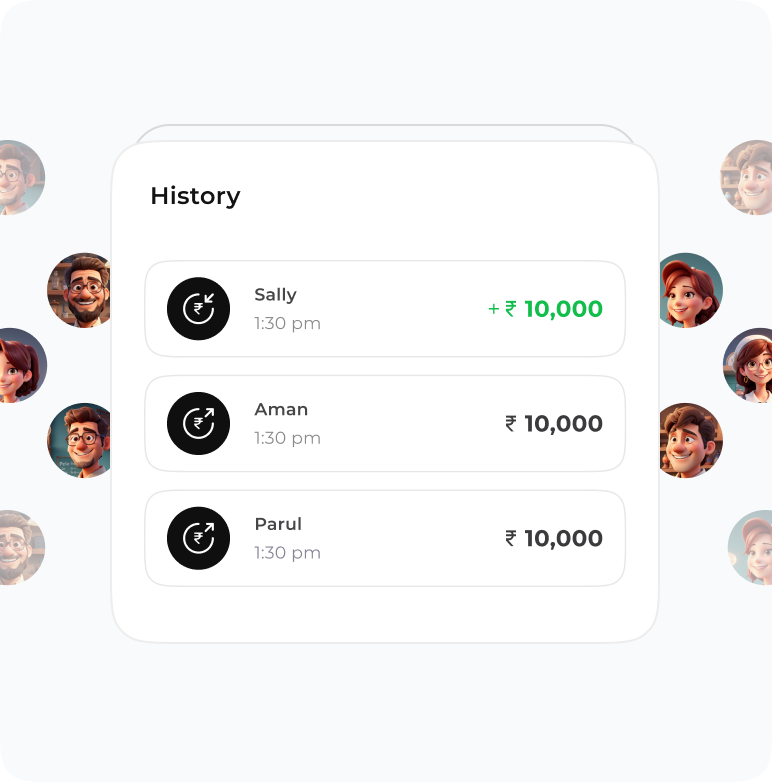

Know the transaction status instantly

At Bulkpe, we're dedicated to empowering the 63 million MSMEs in India, helping them gain complete control over their banking and payments.

Whether you're a large FMCG company, a fintech startup, a hyperlocal business, an F&B enterprise, a multi-branch organization, an NBFC, an accounting platform, an investment platform, a mobile app, a wholesaler, a reseller, a marketplace, an ecommerce site, a SaaS provider, involved in payroll or vendor management, or any other type of small business owner, Bulkpe can transform your business payment processes.

UPI, IMPS, RTGS, NEFT. All four method don’t have any daily or monthly limit.

There's no per day limit like banks. However, there is an INR 1 lakh limit per transaction on UPI, INR 5 lakhs on IMPS, and no limit on NEFT and RTGS.

Open an account in a few minutes by verifying your aadhaar, pan card and business details.

As per RBI guidelines, It is mandatory to verify aadhaar and pan card to create a virtual / individual current account.

Yes, you can. Bulkpe has a sub virtual account feature where you can create individual virtual accounts for each branch, franchisee or business of yours. This will enable you to reconcile transactions easily, and be on top of money in and out.

Bulkpe is a web and mobile application that enables businesses to seamlessly manage money in and out. With Bulkpe, businesses can make bulk payout transactions in a few seconds, and collect payments from customers using UPI, QR, and Bank transfers. Bulkpe also enables businesses to create invoices that can be shared on WhatsApp or email in just one click along with a payment collection URL.